Smart Banks, Smarter Future: A 10 Seconds Glimpse into How Voice AI In Banking Transforming Financial Services?

Voice AI in banking uses natural language processing to understand customer speech and respond instantly. It also handles customer authentication, call routing, and post-call actions automatically, reducing wait times and agent workload.

Top Use Cases In Banking

- Handling routine inquiries (balances, payments, hours).

- Automated upselling/cross-selling during support calls.

- Personalized conversations using CRM integration.

- Outbound loan/due reminders and debt recovery.

Why CallHippo’s Voice AI Is a Game-Changer?

- Real-time conversational intelligence that adapts to context.

- 24/7 multilingual support with regional language recognition.

- Seamless CRM/core system integration for real-time data access.

- Fully secure and compliant with industry standards.

Why CallHippo’s Voice AI Is a Game-Changer?

- Voice AI is becoming a core strategy for banks.

- The global voice banking market is projected to grow significantly by 2032.

- Voice biometrics are being used for secure authentication.

- Smaller banks are adopting voice AI to compete with larger institutions.

Financial institutions face rising service expectations. Customers want faster, more accurate, and personalized support without long call queues. At the same time, internal teams are expected to reduce costs, manage compliance, and handle growing call volumes.

Voice AI in banking addresses these demands with intelligent automation that is consistent, scalable, and regulation-ready. 39% of consumers are already comfortable with AI agents scheduling appointments, reflecting growing trust in voice interactions.

This blog breaks down how voice AI fits into your financial institution, what use cases deliver immediate returns, and how CallHippo’s solution gives your team a powerful edge.

What Is Voice AI in Banking?

Voice AI in banking refers to technology that listens to a customer’s spoken request, interprets the meaning, and provides the correct response, just as a trained human agent would.

Unlike legacy IVR systems, voice AI uses natural language processing. Customers don’t press buttons. They speak normally. The system understands phrases like “I want to check my last three transactions” or “I lost my debit card” and takes action.

A voice assistant in banking connects directly to your internal systems like CRM, core banking, ticketing, or payment gateways. It handles tasks like authentication, account retrieval, and follow-ups in real time. It delivers consistent support, reduces hold times, and frees agents to focus on tasks that require human judgment.

- By 2029, AI agents are expected to handle 80% of routine customer service requests on their own, reducing the need for human involvement in most standard interactions.

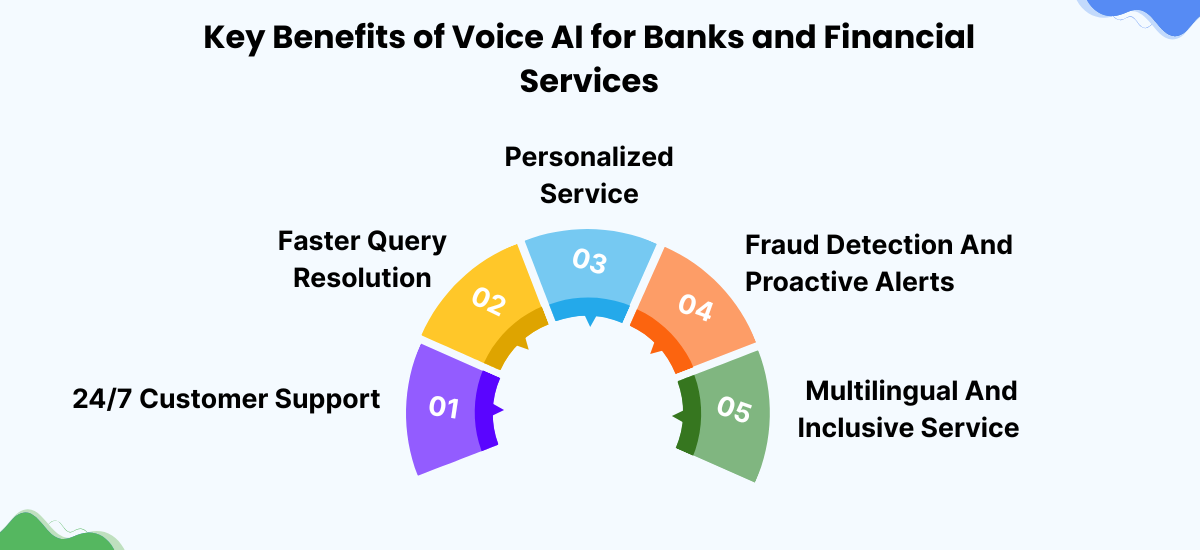

Key Benefits of Voice AI for Banks and Financial Services

Voice banking AI provides measurable improvements across four key banking areas:

1. 24/7 Customer Support

Customers often reach out after hours. Voice AI ensures they still get answers. Whether it’s a balance inquiry at 9 p.m. or a card block request on a holiday, service remains uninterrupted.

2. Faster Query Resolution

By integrating voice technology with your systems, the voice assistant pulls account data, verifies credentials, and responds instantly. Customers no longer wait while agents search for answers.

3. Personalized Service

The system uses past interactions, customer behavior, profiles, and segment data to personalize responses. A returning customer asking about investments may receive options based on their risk category or transaction history.

4. Fraud Detection And Proactive Alerts

Voice-based consent capture, automatic call logs, and secure authentication workflows help maintain regulatory compliance without increasing agent workload. These systems use machine learning to continuously analyze transaction patterns, detect unusual behavior, and trigger real-time alerts to prevent fraud before it impacts the customer.

5. Multilingual And Inclusive Service

Voice AI supports multiple Indian and global languages, making banking more accessible to diverse customer groups, including regional and senior customers who prefer voice communication.

- 83% of sales teams using AI reported revenue growth in the past year, compared to 66% of teams that did not use AI.

Top Use Cases of Voice AI In The Banking Sector

Voice AI is helping banks reimagine how they manage daily customer interactions, service operations, and collections. Below are the most effective use cases where voice ai automation creates real and measurable impact.

1. 24/7 Customer Support

A voice AI agent ensures round-the-clock availability, responding instantly to calls even during weekends, holidays, or peak load periods. It improves consistency and reduces customer frustration.

2. Handling Routine Inquiries (Balances, Hours, Payments)

A significant portion of inbound calls revolves around simple, repeatable queries. Voice AI agent handles these by pulling real-time data from your core systems, offering instant responses about account balances, branch timings, or payment status.

3. Upsell/Cross-sell (Intelligent Suggestions)

While resolving support queries, the voice agent can recognize buying signals and suggest relevant financial products. For instance, if a customer checks their fixed deposit maturity, the assistant can recommend reinvestment options or new term plans.

4. Personalize Interactions (CRM/Marketing Integrations)

When integrated with your CRM or marketing automation platforms, the voice assistant uses past data to personalize responses. It can greet callers by name, reference previous tickets or transactions, and tailor follow-ups accordingly, creating a more connected experience.

5. Loan and Debt Recovery (Reminders, Engagement)

Voice AI can manage outbound engagement for EMI reminders, due notices, or early-stage recovery. It captures customer intent, records responses, and hands off only high-risk cases and complex queries to human agents. This helps in reducing manual calling effort.

6. Intelligent Call Routing (No Touch-Tone Menus)

Instead of relying on keypad inputs, customers can speak naturally. The voice assistant detects intent and routes calls to the right department or specialist, cutting wait times and improving call resolution quality.

- AI-driven systems have improved customer satisfaction by 31.5% and increased retention by 24.8%, highlighting strong improvements in service quality and long-term engagement.

7. Self-service FAQS

Voice AI can resolve standard customer questions drawn from your knowledge base, whether it’s about documentation requirements, interest rates, or service charges. These quick resolutions reduce call transfers and improve first-contact resolution.

8. Smart Scheduling

The assistant checks calendars and availability to book appointments for branch visits, RM callbacks, or product discussions. This removes the need for follow-up coordination and gives customers clarity on next steps right during the call.

9. Billing And Payments

Customers can initiate bill payments, get reminders, or confirm payment status through a quick voice call. The assistant verifies credentials and guides them through the process, ensuring smooth and secure transactions.

10. Document And Record Requests

Voice AI handles requests for account statements, loan documents, and other records. It verifies identity and routes documents through secure channels like email or WhatsApp.

11. Account Support (Balances, Transactions)

Whether it’s a recent debit or a clarification on a failed transaction, the assistant fetches accurate details, explains charges, and logs any discrepancies. This speeds up resolution while keeping your team focused on escalations.

Per User/Month

- Automated Meeting Scheduling

- Transfer Call to Human Agent

- Multilingual Support

- Calendar Booking Assistant

Why CallHippo AI Voice Agent Is a Game-Changer for Voice AI in Banking?

As more customers choose voice channels for everyday banking, institutions need a reliable way to manage conversations at scale without adding operational strain. CallHippo AI voice agent, powered by generative AI, is designed for this environment. It helps banks automate routine queries, support customers, and maintain complete visibility in every interaction. Here are a few ways that prove CallHippo AI Voice agent can be the real game changer for voice AI in banking:

CallHippo complies with industry standards like PCI-DSS, SOC 2, and GDPR to ensure customer data is protected at every touchpoint.

1. Real-Time Conversational Intelligence

CallHippo AI voice agent is an innovative conversational AI solution. It understands the full context of each conversation. It listens to intent, adapts based on account details, and delivers responses aligned with banking protocols.

2. 24/7 Automated Banking Support

CallHippo AI Voice Agent keeps customer support open at all hours. It manages incoming calls for balance checks, card-related issues, account questions, and more. This ensures customers receive immediate help, even during holidays or after business hours. Teams stay focused while the system handles routine inquiries without interruption.

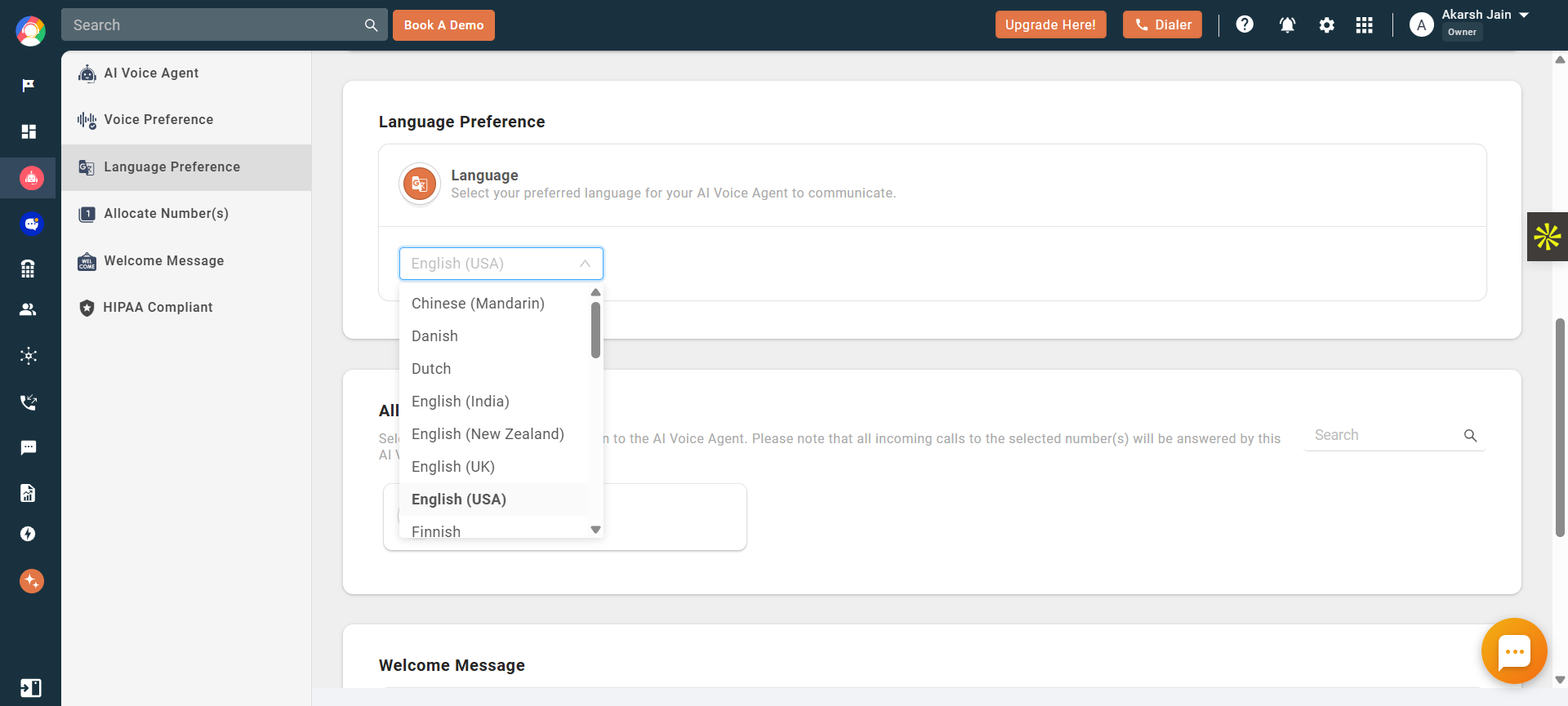

3. Multilingual and Regional Support

The voice agent speaks to customers in the languages they are most comfortable with. It understands regional accents and provides accurate responses in multiple Indian and international languages. This helps your bank extend consistent support to a wider audience and build stronger connections across diverse locations.

4. Seamless CRM and Core System Integration

CallHippo connects directly with your existing systems, like CRM and internal systems. It retrieves account details, updates records, and logs every call without manual steps. Your staff always sees up-to-date information, which shortens resolution times and improves service quality across departments.

- Employees are, on average, 33% more efficient per hour when using generative AI tools.

How To Get Started With Voice AI In Your Financial Institution?

To implement voice AI effectively, you need to follow a structured process that supports operational efficiency and regulatory compliance:

1. Choosing The Right AI Voice Assistant Vendor

Start by evaluating vendors that understand the operational demands of banking environments. Then, prioritize partners who offer data security, multilingual capabilities, CRM, and core banking integrations, and excellent onboarding support. Review their deployment timelines, integration options, and ability to adapt to internal workflows.

2. Pre-Build

Before you start designing conversations, align internally on what the voice assistant should handle. Focus on use cases that are repetitive, easy to automate, and directly impact operational costs and load. Good starting points include balance checks, card status requests, EMI reminders, and appointment bookings.

3. Design

Collaborate with product, CX, and compliance leaders to draft call flows and conversation designs. Implement escalation paths, fallback messaging, dynamic scripting, and multilingual variations where needed. Test tone, phrasing, and response timing to ensure every interaction feels natural and professional.

4. Test

Run a controlled pilot with limited call types or select regions. Monitor KPIs like containment rate, first-call resolution, call duration, and transfer rate. Validate the voice AI agent’s performance against both technical accuracy and customer satisfaction metrics.

5. Launch

Once the pilot shows consistent results, expand your implementation gradually across business units. Use a phased rollout plan covering customer service, collections, product upsell, or onboarding support. Train your internal staff to monitor complex cases and handle escalations efficiently.

6. Optimize

Use analytics to optimize your voice AI regularly. Review call logs to identify missed intents, incomplete journeys, or over-escalated issues. Update scripts based on new and relevant customer patterns, analyze customer data, policy changes, or seasonal query shifts. And ensure that you continue tracking the performance across all live use cases.

- 46% of financial institutions now use AI agents to handle fraud detection and respond to customer inquiries.

Challenges Banks Face When Implementing Voice AI

Adopting voice AI in banking comes with clear benefits, but financial institutions must also navigate certain practical challenges to ensure a successful rollout.

1. Data Security And Regulatory Compliance

Banks operate in a highly regulated environment. AI-powered voice assistants must align with data protection laws, including customer consent, encryption standards, and audit logging. Failing to meet compliance requirements can lead to penalties and loss of trust, so security must be built into the foundation of the system.

2. Integration With Core Banking Systems

For voice AI to provide accurate, real-time support, it needs access to customer data, transaction histories, and account details. Integrating the voice AI with your existing CRM, authentication tools, and core platforms requires thoughtful planning and technical alignment.

3. Onboarding And Configuration Time

Banks need to define workflows, train the system with real queries, create customer-friendly scripts, and test functionality. Without a clear plan, deployment can face delays and miss key performance goals.

4. Customer Experience And Trust

Some customers are still skeptical about speaking with automated systems. To maintain service quality, it’s important to offer an easy handover to human agents when needed. A well-designed voice AI setup should make this transition seamless, without causing customer frustration or added wait times during customer calls.

5. Change Management Across Teams

Introducing voice AI can impact operations, customer service processes, and team workflows. Staff may need training to work alongside automated systems. Managing this change and aligning internal stakeholders is important for long-term success.

Market Trends And Adoption

Voice AI is gaining steady momentum in banking as institutions look for scalable ways to improve service, reduce operational load, and meet rising customer expectations. Here are five key market trends and adoption strategies that you will not regret knowing about:

1. Banks Are Moving Voice AI Into Core Strategy

Over 70% of banking executives are actively exploring voice AI as a key part of their digital transformation efforts. It’s being treated as core infrastructure for customer engagement, not a test initiative.

2. Market Growth Signals Long-Term Investment

The global AI voice generator market is expected to grow from USD 3,563.9 million to USD 21,754.8 million by 2030, growing at a CAGR of 29.5% from 2024 to 2030. This growth is being driven by rising demand for personalized and engaging user experiences across various industries.

3. Operational Efficiency Is a Clear Driver

Banks are using voice AI to automate 15–35% of daily service activities. This includes balance checks, document requests, and appointment scheduling, reducing pressure on call centers while improving response time.

4. Voice Biometrics Are Strengthening Authentication

Banking institutions are adopting voice-based verification to replace passwords and security questions. This improves user experience while enhancing fraud prevention and compliance.

5. Smaller Banks Are Using Voice AI to Close the Experience Gap

With multilingual support and emotion-aware interactions now more accessible, small and mid-sized banks are delivering service levels that rival large institutions without scaling up staffing.

Conclusion

Voice AI is becoming a practical asset for banks looking to scale service, reduce manual workloads, and meet rising customer expectations. It allows institutions to handle higher volumes without adding pressure on teams, while also delivering consistent and personalized customer interactions.

As customer expectations rise and cost control remains a priority, voice assistant banking offers a clear path forward. With the right implementation, it can strengthen support systems, improve compliance, and create meaningful long-term value for both customers and operations.

See how CallHippo’s AI Voice Agent can support your goals. Try it for free and explore its impact across your service workflows.

Frequently Asked Questions

Can small banks also benefit from voice AI technology?

Yes, small banks benefit from using voice AI technology. The voice agent can help manage 24/7 customer queries without the need for a large team.

Is voice AI banking secure for financial transactions?

Yes. When properly configured, voice AI solutions like CallHippo use end-to-end encryption, secure voice logging, and comply with financial regulations such as PCI-DSS and GDPR. Banks can also implement voice biometrics and consent-based workflows for added safety.

Can voice AI in banking be used for outbound banking calls like loan reminders or payment follow-ups?

Yes, you can set up automated outbound banking calls for alerts, reminders, or promotions.

Does CallHippo offer multilingual support for banking customers?

Yes, CallHippo AI voice agent offers multilingual support for banking customers, making it accessible to a wide audience.

Subscribe to our newsletter & never miss our latest news and promotions.