The insurance industry has undergone a digital transformation, with conversational AI in insurance emerging as a key enabler of innovation and efficiency. From improving customer engagement to streamlining operations, conversational AI is reshaping how insurers operate in today’s competitive market.

This blog will show how conversational AI can be implemented in the insurance industry and its benefits.

What is Conversational AI?

Conversational AI refers to technologies that enable machines to interact with humans in a natural, conversational manner. These systems utilize natural language processing (NLP), speech recognition, machine learning, and artificial intelligence to understand, process, and respond to human inputs. The key differentiator of conversational AI is its ability to engage in multi-turn conversations, understand context, handle follow-up questions, and deliver more relevant responses.

In the insurance sector, conversational AI solutions are implemented through chatbots, voice assistants, and virtual agents to provide instant support, handle complex queries, and drive business outcomes.

To get the most out of conversational AI in the insurance industry, I suggest focusing on continuous improvements by regularly updating your AI systems. This way, you ensure they stay relevant to evolving customer needs and compliance standards. Also, don't forget to keep the human touch—AI should complement human empathy, not replace it.

Use Cases of Conversational AI in Insurance

Conversational AI has proven to be a game-changer for the insurance industry by addressing multiple operational challenges and enhancing customer interactions. Let’s dive into the specific use cases where conversational AI insurance solutions have made a significant impact.

1. Automating Claims Processing

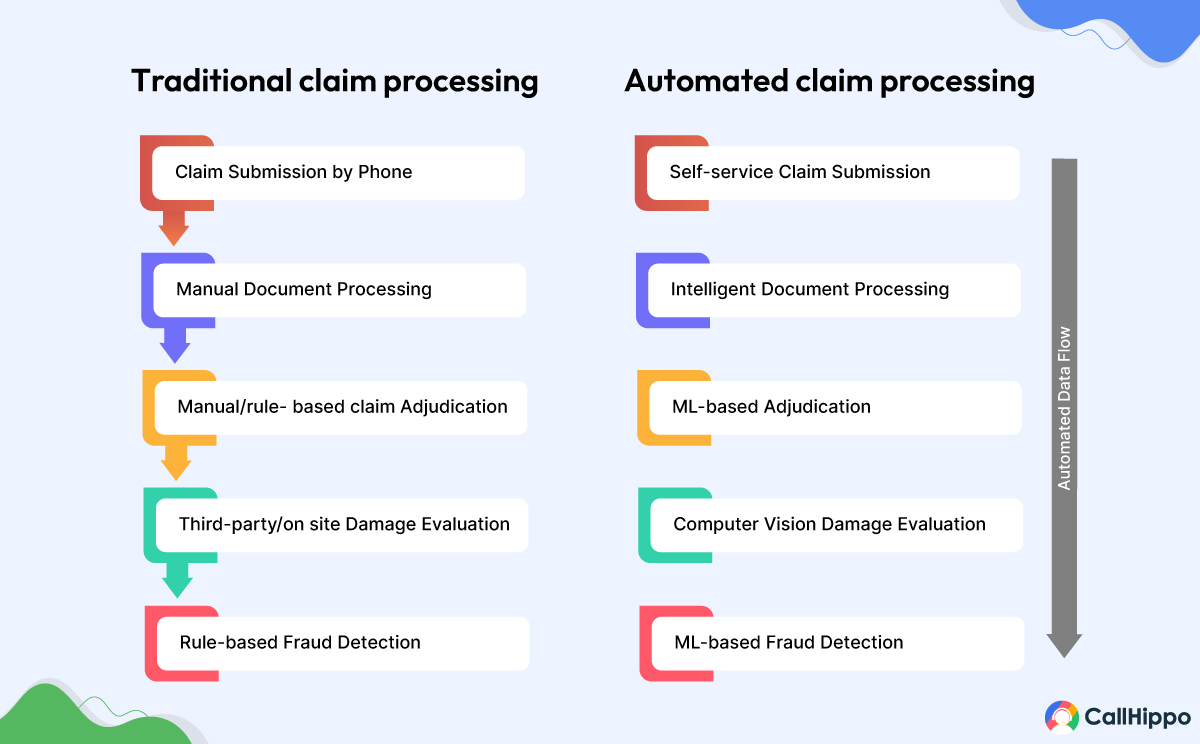

Claims processing is one of the most time-consuming tasks in the insurance sector. With conversational AI for insurance, customers can initiate claims through chatbots or virtual assistants by simply providing essential information such as policy details, incident reports, and documents.

AI systems can validate the submitted information, cross-check it with policy terms, and even provide real-time updates on claim status. This automation reduces processing time, minimizes errors, and improves customer satisfaction by offering a hassle-free claims experience.

2. Streamlining Policy Inquiries

Handling a large volume of policy-related questions is challenging for customer service teams. Conversational AI efficiently addresses queries like policy coverage, premium due dates, and renewal processes.

For instance, a chatbot on an insurance company’s website can instantly respond to a user’s inquiry about whether their home insurance policy covers flood damage. By delivering quick and accurate answers, AI enhances the overall customer experience and reduces the burden on human agents.

3. Providing Personalized Product Recommendations

Conversational AI excels in analysing customer data to provide tailored recommendations for insurance products. By assessing a customer’s demographics, previous policies, and preferences, AI-powered virtual agents can suggest plans that align with individual needs.

For example, a voice agent could recommend a travel insurance policy to a customer planning an international trip, highlighting the benefits and coverage options most relevant to their destination and duration of travel.

4. Cross-Selling and Upselling Opportunities

Insurance conversational AI is a powerful tool for cross-selling and upselling. By analyzing customer profiles and behaviors, AI can identify additional products that may interest them.

5. Fraud Detection and Prevention

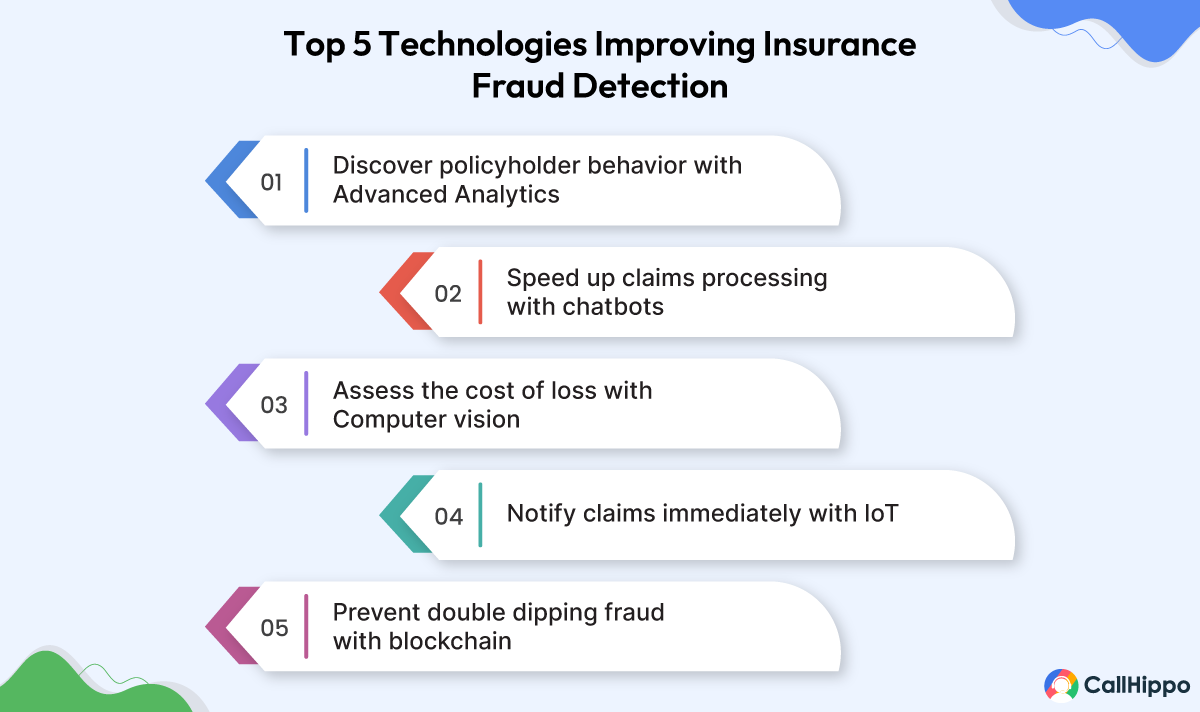

Fraud is a significant concern in the insurance industry, leading to substantial financial losses. Conversational AI can help detect potential fraudulent activities by analyzing patterns in customer interactions and claim submissions.

For instance, if a virtual assistant identifies inconsistencies in a claimant’s story or notices unusual behavior, it can flag the case for further investigation. This early detection capability reduces risks and strengthens the integrity of the claims process.

6. Simplifying Underwriting Processes

Underwriting involves assessing risk and determining appropriate premiums for insurance policies. Conversational AI simplifies this complex process by gathering relevant customer data and analysing it in real-time.

For example, an AI-powered voice agent can collect details about a customer’s health history, lifestyle, and preferences, providing underwriters with a comprehensive dataset. This not only accelerates the underwriting process but also ensures greater accuracy in risk assessment. : Conversational AI in Healthcare: Transforming Patient Care

7. Proactive Renewal Reminders

Policy renewals are critical for maintaining customer retention. Conversational AI systems can send automated reminders about upcoming renewal dates and guide customers through the process seamlessly.

For example, a voice agent might notify customers about their auto insurance renewal a month in advance, offer premium payment options, and provide information about potential discounts for early renewals. This proactive approach reduces policy lapses and keeps customers engaged.

8. Customer Education and Awareness Campaigns

Insurance can be a complex topic for many customers. Conversational AI assists in educating customers about policies, coverage options, and claim procedures through interactive and easy-to-understand communication.

For instance, virtual assistants can guide users through video tutorials, infographics, or FAQs on topics like “How to Choose the Right Health Insurance Plan.” These campaigns help demystify insurance and empower customers to make informed decisions.

9. Appointment Scheduling for Agents

While conversational AI handles many interactions, some situations require personal assistance. AI systems simplify appointment scheduling by allowing customers to book consultations with agents through a virtual assistant.

For example, a customer interested in discussing a life insurance policy can schedule a meeting with a financial advisor based on their availability and preferences. This feature ensures a smooth transition between digital and human interactions, enhancing the overall customer journey.

These diverse use cases showcase how conversational AI in insurance is not just a technological upgrade but a strategic enabler that enhances efficiency, drives customer satisfaction, and fosters innovation across the sector.

Per User/Month

- Automated Meeting Scheduling

- Transfer Call to Human Agent

- Multilingual Support

- Calendar Booking Assistant

Best Practices for Implementing Conversational AI in Insurance

Implementing conversational AI in insurance requires a well-thought-out strategy to ensure the technology delivers its full potential. By following best practices, insurers can maximize the benefits of AI while minimizing risks.

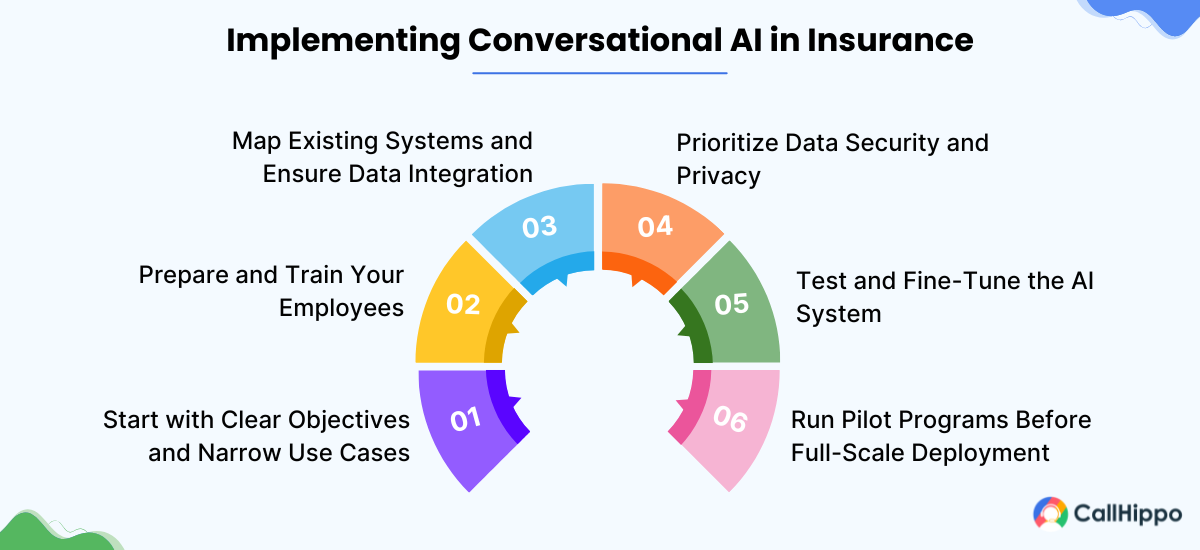

1. Start with Clear Objectives and Narrow Use Cases

Before diving into implementation, it’s crucial to define clear objectives for deploying conversational AI. Insurers should identify the specific challenges they aim to address, such as reducing claim processing time or improving customer engagement.

Focusing on narrow, high-impact use cases initially—like automating policy inquiries or sending renewal reminders—ensures that the implementation is manageable and delivers measurable results. As the system proves its value, insurers can expand to more complex applications.

2. Prepare and Train Your Employees

The introduction of conversational AI can cause apprehension among employees who may view it as a replacement for their roles. To ensure a smooth transition, it’s vital to communicate the purpose of AI as a tool that enhances efficiency and supports human agents, rather than replacing them.

Comprehensive training programs should be conducted to familiarize employees with the capabilities of AI tools and teach them how to collaborate effectively with these systems. For instance, customer service teams can learn to handle escalations from chatbots or use AI-driven insights to personalize customer interactions.

3. Map Existing Systems and Ensure Data Integration

For conversational AI to function effectively, it must integrate seamlessly with an insurer’s existing systems, such as customer relationship management (CRM) platforms, claim management software, and policy databases.

A thorough mapping of current systems is essential to identify potential integration challenges. API-based integrations and middleware solutions can help bridge gaps, enabling the AI to access real-time data for accurate responses. For example, linking the voice agent to a policy database allows it to fetch personalized policy details instantly when queried by customers.

- Conduct regular audits of data flow and system compatibility to prevent bottlenecks during integration. Additionally, establish data governance protocols to ensure security and compliance while enabling smooth AI interactions.

4. Prioritize Data Security and Privacy

Insurance companies handle sensitive customer data, making security and privacy paramount. Conversational AI systems must comply with regulatory requirements such as GDPR, HIPAA, or other local data protection laws.

To safeguard data, insurers should implement robust encryption protocols, secure APIs, and regular security audits. Additionally, conversational AI tools must be programmed to handle sensitive information cautiously, ensuring that no unauthorized access or data breaches occur. For instance, voice agent should authenticate users before sharing confidential policy or claim details.

5. Test and Fine-Tune the AI System

A conversational AI system is only as good as the training it receives. Rigorous testing is essential to ensure the system can handle a variety of queries, including complex or ambiguous ones.

During the testing phase, insurers should simulate real-world interactions to identify gaps in understanding, responsiveness, or accuracy. Based on these insights, the AI system can be fine-tuned to improve its performance continuously. Regular updates and retraining with new data will help the system stay relevant and effective over time.

6. Run Pilot Programs Before Full-Scale Deployment

Before launching conversational AI across the entire organization, insurers should run pilot programs to evaluate its performance in a controlled environment.

For instance, a pilot program could involve deploying a voice agent to handle claim inquiries for a specific product line or region. This allows insurers to assess the system’s efficiency, gather user feedback, and identify areas for improvement. Based on the pilot’s success, the AI solution can be scaled gradually to other functions or regions.

By adhering to these best practices, insurance companies can implement conversational AI systems that drive tangible results, enhance customer satisfaction, and streamline operations while minimizing risks and disruptions.

How CallHippo AI Voice Agent Drives Sales for Insurance Industry?

CallHippo AI Voice Agent is a transformative tool for the insurance industry. By automating routine tasks and streamlining customer interactions, it enables insurers to focus on more complex and high-value tasks. This conversational AI platform by CallHippo offers significant advantages in lead generation, customer support, and personalized sales strategies, enhancing operational efficiency and boosting customer satisfaction.

1. Automated Lead Generation

AI voice agents can automate lead generation by actively engaging with prospects and collecting relevant information, such as preferences and needs. This reduces the manual effort involved in prospecting, allowing insurance companies to focus on nurturing qualified leads and converting them into long-term customers.

2. 24/7 Customer Support

AI voice agents provide round-the-clock customer support, ensuring that clients can get assistance at any time, regardless of business hours. This continuous availability helps to enhance customer satisfaction by providing timely responses to queries and concerns, improving overall service quality and accessibility.

3. Personalized Interactions

By analyzing customer data, AI voice agents deliver highly personalized interactions. They can suggest relevant insurance products based on an individual’s preferences, life stage, and previous interactions, creating tailored recommendations that increase the likelihood of conversion and customer retention.

4. Data-Driven Insight

AI-powered virtual assistants gather and analyze large volumes of data, providing insurers with valuable insights into customer behavior, trends, and needs. This data-driven approach helps insurers make informed decisions about product offerings, marketing strategies, and sales processes, optimizing their operations and customer engagement efforts.

Benefits of Conversational AI in the Insurance Sector

The adoption of conversational AI is transforming the insurance industry by streamlining operations and enhancing customer interactions. These AI-driven solutions provide a competitive edge, enabling insurers to deliver faster, more personalized services while reducing costs.

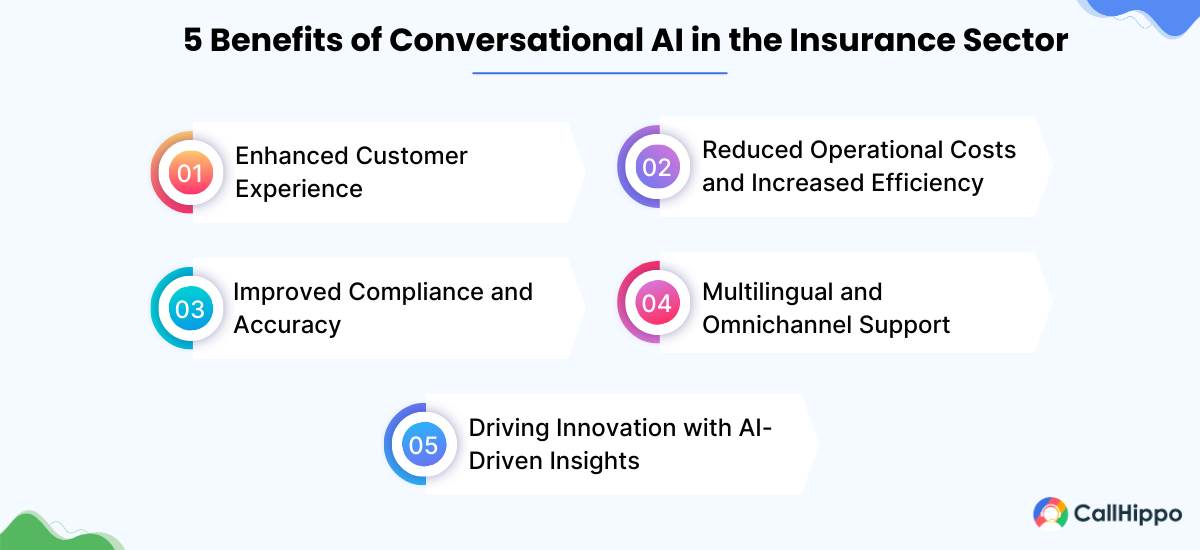

1. Enhanced Customer Experience with 24/7 Support

Conversational AI for insurance allows companies to provide uninterrupted, round-the-clock support to their customers. Policyholders can access information about their coverage, file claims, or get answers to frequently asked questions anytime, anywhere. This leads to higher customer satisfaction and fosters trust between insurers and their clients.

2. Reduced Operational Costs and Increased Efficiency

One of the primary advantages of insurance conversational AI is its ability to automate repetitive tasks, such as ai answering policy-related queries or processing claims. By handling a significant volume of customer interactions, conversational AI reduces the workload on human agents, enabling them to focus on more complex tasks. This results in substantial cost savings and improved operational efficiency.

3. Improved Compliance and Accuracy

Insurance companies must adhere to strict regulatory requirements, making compliance a critical aspect of their operations. Conversational AI ensures accuracy in communications, reducing the risk of human error. It can also be programmed to provide responses that align with regulatory standards, ensuring that all customer interactions remain compliant.

4. Multilingual and Omnichannel Support

The global reach of insurance companies often demands communication across multiple languages and platforms. Conversational AI insurance solutions can be deployed to support various languages and integrate seamlessly across channels such as websites, mobile apps, and social media. This enables insurers to offer a consistent and personalized experience to their diverse customer base.

5. Driving Innovation with AI-Driven Insights

Conversational AI systems gather valuable data from customer interactions, which can be analyzed to uncover trends, preferences, and pain points. These insights help insurers refine their offerings, create targeted marketing campaigns, and develop innovative solutions tailored to customer needs.

By leveraging conversational AI in insurance, companies can not only address current challenges but also position themselves as forward-thinking leaders in the industry. Stay tuned as we delve deeper into specific use cases and success stories in the upcoming sections.

Challenges of Implementing Conversational AI and How to Overcome Them

While conversational AI in insurance offers numerous advantages, its implementation comes with challenges that need to be addressed strategically. Below are some of the key challenges insurers face and actionable ways to overcome them.

1. Addressing Customer Data Privacy Concerns

Insurance companies handle sensitive customer data, including financial information, health records, and personal identification details. Implementing conversational AI raises concerns about data security, especially when dealing with regulatory requirements like GDPR, HIPAA, or other local laws. Customers may hesitate to use AI systems if they perceive a risk to their privacy.

- To address these concerns, insurers must implement robust data security measures. This includes encrypting all data transmissions, securing API endpoints, and using multi-factor authentication for sensitive transactions.

2. Integrating AI Seamlessly with Legacy Systems

Many insurance companies rely on legacy systems that are not designed to integrate with modern AI technologies. This creates a significant barrier to implementing conversational AI, as these systems often lack the flexibility required for real-time data sharing and processing.

- To overcome this challenge, insurers should conduct a comprehensive assessment of their existing systems and identify integration points. Middleware solutions or API gateways can act as bridges between conversational AI systems and legacy infrastructure, enabling smooth data flow.

3. Managing Multilingual and Omnichannel Interactions

Insurance companies serve a diverse customer base that interacts through various channels, including websites, apps, social media, and messaging platforms. Providing consistent, high-quality support across these channels in multiple languages is a complex task for conversational AI systems.

- Insurers should invest in conversational AI platforms that offer advanced natural language processing (NLP) capabilities, including multilingual support. This allows the system to understand and respond accurately in various languages, catering to customers from different regions.

The Future of Conversational AI in Insurance

The future of conversational AI in insurance is set to be transformative, with advanced technologies driving new levels of personalization, efficiency, and innovation. By harnessing emerging trends, insurers can unlock unprecedented value for both their operations and customers. Let’s explore what the future holds.

1. Predictive Analytics for Proactive Customer Engagement

Conversational AI will increasingly leverage predictive analytics to anticipate customer needs and engage them proactively. By analyzing historical data, customer behavior, and market trends, AI systems will predict events such as when a customer might need additional coverage, renewal assistance, or even personalized financial advice.

For example, if an AI system detects that a customer has recently purchased a new car, it could proactively offer relevant auto insurance options tailored to their needs. Similarly, based on weather data, AI can alert homeowners in areas prone to natural disasters about insurance policies designed for emergency coverage.

2. AI-Driven Decision Making in Policy Management

AI will play a critical role in automating and enhancing decision-making processes in policy management. From underwriting to claims processing, conversational AI systems will integrate with advanced algorithms to provide data-backed recommendations and real-time decisions.

For instance, an AI system could instantly determine the risk profile of a new customer applying for life insurance by analyzing medical records, lifestyle data, and genetic predispositions. It could also dynamically adjust policy terms or premiums based on changes in a customer’s behavior, such as adopting healthier habits.

3. Enhanced Collaboration Between AI and Human Agents

The future of conversational AI insurance lies in seamless collaboration between AI systems and human agents. While AI will handle routine queries and data-driven tasks, human agents will focus on building relationships and addressing complex cases that require empathy or nuanced understanding.

For example, AI voice agent could triage incoming customer queries, resolving simple issues instantly while routing more complex ones to human agents along with contextual information. This hybrid model not only enhances efficiency but also ensures a personalized touch in customer service.

Looking Ahead

As conversational AI continues to evolve, its role in the insurance industry will expand beyond customer service to encompass strategic decision-making, predictive engagement, and hybrid collaboration models. Insurers who embrace these advancements early will position themselves as industry leaders, delivering unparalleled value and innovation in an increasingly competitive market.

Choosing the Right Conversational AI Platform for Insurance

Selecting the right conversational AI platform is a critical step for insurers aiming to streamline operations, improve customer experiences, and stay ahead in a competitive market. With numerous options available, identifying the platform that aligns with business needs and long-term goals requires a strategic approach.

1. Key Features to Look for in an AI Platform

When choosing a conversational AI platform, ensure it has advanced natural language processing (NLP) capabilities for understanding customer inquiries, multilingual and omnichannel support to cater to a diverse customer base, and robust integration options to connect with existing systems like CRM and claims management.

Additionally, prioritize security features to comply with data protection regulations, scalability to accommodate future growth, and analytics tools to track performance and improve customer engagement.

2. Assessing ROI and Long-Term Benefits

Assessing ROI involves evaluating both immediate cost savings and long-term benefits such as reduced operational costs, improved customer satisfaction, and higher retention rates. It’s essential to track metrics like the efficiency of claim processing, routine inquiries automation, and revenue growth potential through upselling and cross-selling.

The right platform should ultimately offer measurable improvements in both operational efficiency and customer experience, leading to sustainable growth and a competitive edge.

Final Thoughts

The integration of conversational AI in insurance is reshaping the industry by streamlining operations, enhancing customer experiences, and driving innovation. With AI-powered solutions like virtual sales agents, insurers can automate lead generation, offer personalized customer support, and make data-driven decisions that increase efficiency and profitability.

By carefully selecting the right AI platform and embracing these cutting-edge technologies, insurance companies can stay competitive in an evolving market while delivering superior service and value to their customers. The future of insurance is undoubtedly AI-driven, and those who adapt early will reap significant long-term rewards.

Subscribe to our newsletter & never miss our latest news and promotions.