One of the toughest aspects of being a call center agent is coping with customers expressing anger or frustration. Research shows that 33% of customers report being most frustrated by waiting on hold, while another 33% are most upset by having to repeat themselves to multiple customer service representatives. With two-thirds of callers feeling irritation before they even speak to you, it’s clear that call center employees need effective strategies to handle upset customers.

You have the power to turn difficult customers into positive ones with the right techniques. Doing so benefits both the customer and your company. Dissatisfied customers are unlikely to remain loyal or recommend you, while happy customers become repeat purchasers and refer others.

Managing these emotions is hard work but also incredibly valuable. When an upset customer leaves an interaction feeling heard and helped, that restores their trust in your company and makes your efforts worthwhile. Read on to pick up 12 tips for handling angry and disgruntled customers – and making every interaction with a customer positive!

"Empathy, patience, and active listening are key in handling angry customers in a call center. Always acknowledge their feelings, apologize sincerely, and offer solutions promptly. Remember, their anger is not personal but a reaction to a situation. Focus on solving the problem, not arguing. Consider implementing a robust training program for agents, focusing on emotional intelligence and conflict resolution. This will equip them with the necessary skills to handle such situations effectively and maintain customer satisfaction and retention."

How Angry Customers Affect Your Business?

Customer satisfaction is paramount to success in the fast-paced and competitive business world. However, even with the best products and services, dealing with angry customers is an inevitable challenge that all businesses face.

Understanding how customer anger impacts them is essential for any organization that aims to flourish in the market. Here, we will explore how angry customers can profoundly affect your business and highlight how to handle angry customers in a call center and address their concerns.

1. Offers Lesser Customer Value

The goal of any business organization should be to offer maximum customer value. Customer value or Consumer value is the value a customer perceives to receive from a product. Some of the main factors that weigh on customer value are:

- Efficiency: how effective is the product or service?

- Status: how worthy is the product to gain external appreciation?

- Worth: is the cost paid to procure the product worth it? The cost here means the monetary value of the product, efforts needed to find/research about it, pleasantness or unpleasantness of the customer experience, time spent to purchase it, etc.

For instance, an unpleasant customer experience post-sales increases the price a customer pays for a product. Therefore, as a sales representative, your priority should be to resolve the issues asap, to not make the customer feel that they paid an unaffordable price for the product.

2. Reduces Lifetime Customer Value

Customer care representatives can handle everything, refunds, concerns, and product details. But the biggest question is how to handle irate customers. And one can make or break a customer relationship if one fails to answer this.

According to Salesforce Research, 74% of customers will switch brands if they perceive the buying experience as too difficult. And a big determining factor of this is how you would handle an irate customer as a customer service representative. So, the better you are at pacifying angry and pleasing unhappy customers, the longer they stay with your brand.

3. Increases Negative Word-Of-Mouth Marketing

In this hyper-connected world, one complaint mentioned on social media can create a negative brand image for everyone who sees it. A bad review or rating can massively affect your customer inquiry, acquisition, and sales numbers – as the first thing prospective customers see is the highest-rated seller amongst the list of many. And displeased customers would share their experiences with their friends and family, who will then be most unlikely to be interested in your business.

4. Loss of Revenue

Regardless of the size of your company, your brand image is directly proportional to your sales. Research suggests that subpar customer service costs businesses a massive $75 billion annually, giving us a good perspective on the importance of dealing with irate customers.

5. Leads To Poor Performance

Dealing with angry customers can often be challenging and emotionally draining for call center agents. If an agent handles the interaction poorly, it can decrease performance and productivity. Being yelled at and berated day after day can cause agents to become irritable, impatient, and unable to focus fully on the task at hand.

They may rush through calls to end the interaction quicker. Some agents may avoid taking calls altogether. This results in high absenteeism, decreased customer satisfaction, and poor call resolution rates. To avoid poor performance, agents need training on controlling their own emotions, de-escalating conflicts, and focusing on resolving the issue rather than reacting negatively. With the right skills, agents can defuse anger and maintain composure.

You May Also Read : Empathy Statements for Customer Service

Why Is It Crucial to Handle Difficult Customers?

Dealing with upset customers is an inevitable part of working in a call center. While it may not be the most enjoyable part of the job, it is critically important for agents to handle these situations professionally. There are several key reasons why effectively dealing with difficult customers should be a top priority:

1. Retaining Customers

When an upset customer feels heard and their complaint is resolved, they are likely to continue doing business with your company. By acknowledging their frustration and helping find solutions, you demonstrate a true commitment to customer service. According to research, 81% of customers say they will likely make another purchase if they receive good service during a complaint.

2. Identifying Business Issues

Analyzing customer complaints can highlight problems or shortcomings in your business operations. If multiple people complain about the same thing, that’s a clear sign that certain processes, training programs, or tools may need review and improvement. Taking these complaints is imperative for ongoing business success. Even a 5% increase in retention from improved complaint handling can boost profits by 25-95%.

3. Avoiding Future Problems

The lessons learned from handling difficult customers provide valuable insights for your call center team. Identifying common complaints allows managers to implement better workflows and protocols to avoid similar issues.

Now that you know how to calm an angry customer, we have listed the best ways to handle angry customers below.

12 Ways How to Handle Angry Customer in Call Center?

Dealing with an angry customer can be challenging for any call center agent. However, there are effective techniques you can use to defuse the situation and satisfy the customer. Below are the 12 best methods for handling irate callers in a call center environment. Read on to learn simple yet powerful approaches to turning an angry customer into a happy one –

1. Practice Reflective Listening

When an angry customer calls, most sales reps become defensive and blurt out facts in response that are best known to them. Here, the answers are not incorrect, but responses can be optimized.

Here’s a scenario:

- Customer: “I’m frustrated because I have a limited budget, and you’re unwilling to offer us a discount, even when I regularly purchase from you.”

- Customer Success Manager: “You are not eligible for coupons or discounts because it is not showing in our system.”

Here the customer will feel unpleasant not just because they did not get a discount – but because the problem they laid out vulnerably was not heard and valued.

Here is where reflective listening comes into play. It helps you be perceived as empathetic even when you aren’t one. Reflective listening requires understanding what the other person is saying by interpreting their words, emotions, wants, and motivation.

Once you’ve analyzed this, you respond by reiterating their thoughts and feelings back to them, asking if you heard them right, and validating their feelings by saying that you understand them.

Example of practicing reflective listening:

- Customer: “I’m frustrated because I have a limited budget, and you’re unwilling to offer us a discount, even when I regularly purchase from you.”

- Sales Rep: “So, I’m hearing that our pricing is a barrier for your business. And I’m not offering a discount that meets your needs, even when you are our regular customer. Is that correct?”

- Customer: Yes

- Sales Rep: I understand, I value your association with us, and I would be more than happy to get you the discount you desire, but since company policies bind me, I, unfortunately, wouldn’t be able to process one at the moment.

Never promise to fix the situation — because it might not be under your control. Your aim should be to make your customer feel heard and valued.

2. Be Aware Of The Customer’s Past History

You don’t want customers to repeat unpleasant experiences to you — that’s agonizing. It will only make them angrier and increase the level of dissatisfaction.

Also, it would help if you had a fuller picture of what has been happening when you start interacting with the angry customer.

It is best to then have the following information beforehand or early on during the interaction:

- The product/service they are inquiring about

- Their past interactions with your company — who did they speak to – status of those queries

- Length of their association with your company

- Their previous purchases

- And lastly, their concern and needs

With this information, you can quickly resolve them, not requiring them to repeat their concerns. You will also be able to effectively help an angry or displeased customer and tailor your solutions accordingly.

Bonus Tip:

A call center software is suggested to give you a unified view of all this real-time information at a glance.

3. Tap into the Philosophy of Beginner’s Mind

The beginner’s mind is also known as the zen mind. It is the method of approaching every situation as if you were a beginner in knowing about that situation. When you use this way of thinking, you conduct all conversations with the “don’t know” mindset. This prevents you from prejudging a customer or their situation, which is a major help in dealing with upset customers.

Zen’s mind encourages you to live without “shoulds.” This gives way to nagging thoughts like:

- The customer should have read the return policy.

- The customer should have read my reminder email about their discount expiration.

- The customer should not have assumed my availability for weekly consultations.

“Shoulds” makes you angry and defensive and thus jeopardize your ability to appease an angry customer. This increases the likelihood of the conversation tail spinning.

With the zen mind, you let go of any conclusions; you make leeway in your mind for their customer – you give them the benefit of the doubt and become more receptive to understanding their situation. There could be many times when a customer has justifiable anger. And 100% of the time, your job as a customer service and support executive is to assist the customer.

4. Remain Calm

Being a calm and unagitated person can require practice; here are ways to become one to effectively deal with angry conversations:

A. Meditate

Give yourself 15 minutes every day and sit with yourself without thoughts. No screens, work, or distractions. You will be amazed at how much lighter you feel. This time will help you gain a clear sense of self; you will know that the real you cannot get affected by the misbehavior of others, and you were not the person who caused it.

B. Choose Feelings & Emotions & Not Let Them Choose You

Practice witnessing your feelings and emotions. Catch yourself when they get the best of you. Your actions should never be affected by your feelings and emotions, as that may cause you to not be particularly rational. However, rationally choose feelings and emotions and have better conversations and relationships at work (and in life).

C. Don’t Have A Black & White Approach

Do not rely on quickly-formed conclusions. Avoid extreme conclusions and reactions. Being gray will help you forgive and focus on long-term goals, in this case, the customer lifetime value.

5. Not Being Too Imaginative & Starting With Worst-Case Scenarios

Fear is common in sales reps when they are on a call with a disgruntled caller. Fear of a negative outcome affects how we act.

In fear, we are more likely to react defensively than to respond proactively. And this fear is caused by being too imaginative and starting with worst-case scenarios.

While facing a difficult customer, some sales reps often see losing this customer for life as an outcome. And they would thus feel that having a truthful conversation with them might damage business-customer relationships.

To tackle this issue, do not imagine the worst-case scenario first. While speaking with an angry customer – listen, understand, and break down issues in smaller chunks to approach the immediate problem.

Also, know that angry customers are easy to please once you understand them enough. You should also know that you can always contact your supervisors to help.

Finally, you need to know that your job is to give your best in dealing with angry customers – and be okay with whatever the outcome is.

6. Know Who You Are Speaking To

You and your staff should always be cautious about the words you choose and whom you speak to. It is a wise idea to gauge the customer’s basic information first to use the language best suited to the scenario. For instance, an angry young businessman or businesswoman must get dealt with differently from an elderly irate consumer.

A. Emotionally Wound-Up Caller

Most customers might want someone to vent out to. They may have a lot of things going on in their personal life. Unfortunately for you, the thing that tipped them over the edge was the unexpected bill from your company. To know this, you must learn to be empathetic towards customers’ emotions, give them the benefit of the doubt, and use empathetic language.

Try using phrases like, “I’m sorry you feel this way,” or, “May I suggest …” or “I understand ….”

B. Legitimately Wronged Caller

A customer with a genuine problem has a reason to be annoyed at your business. Your company is in the wrong; you need to acknowledge this and be humble and apologetic about it.

Try saying things like, “I’m so sorry that it had to be this way,” or “I will do this for you immediately.”

C. Too Creative With Words Caller

It is particularly hard to deal with an abusive customer. Nobody is expected to put up with angry customers being overtly unpleasant to them. However, your responsibility is still to stay calm and calm them down. It would help if you always used professional language — don’t forget that your calls are recorded.

Try saying, “I understand your issue, but we don’t tolerate this language you are using.” Or “You seem very upset; would you like to continue this conversation through email?”.

Bonus Tip:

While dealing with angry phone calls, it’s best to use positive and calming language abundantly. Use terms like “yes,” “definitely,” “understand,” and “do not worry.” It will help you be a rockstar in dealing with angry customers.

7. Establish Trust

Trust is the most potent factor to enhance customer experience and increase customer loyalty.

Once you establish trust with angry customers, you develop a personal connection with them. This will allow them to be less over-reactive, more tolerant of your company. This does not mean you are lenient in dealing with them, but it ensures a seamless long-term association.

You can establish trust in the following ways:

A. Be Truthful:

Customers quickly notice when you are lying, and you doing this while they are angry will only enrage them further. The best way to calm an angry customer is, to be honest with them. Honesty will help you resolve issues quickly and establish deep trust.

B. Own Up To Your Mistakes:

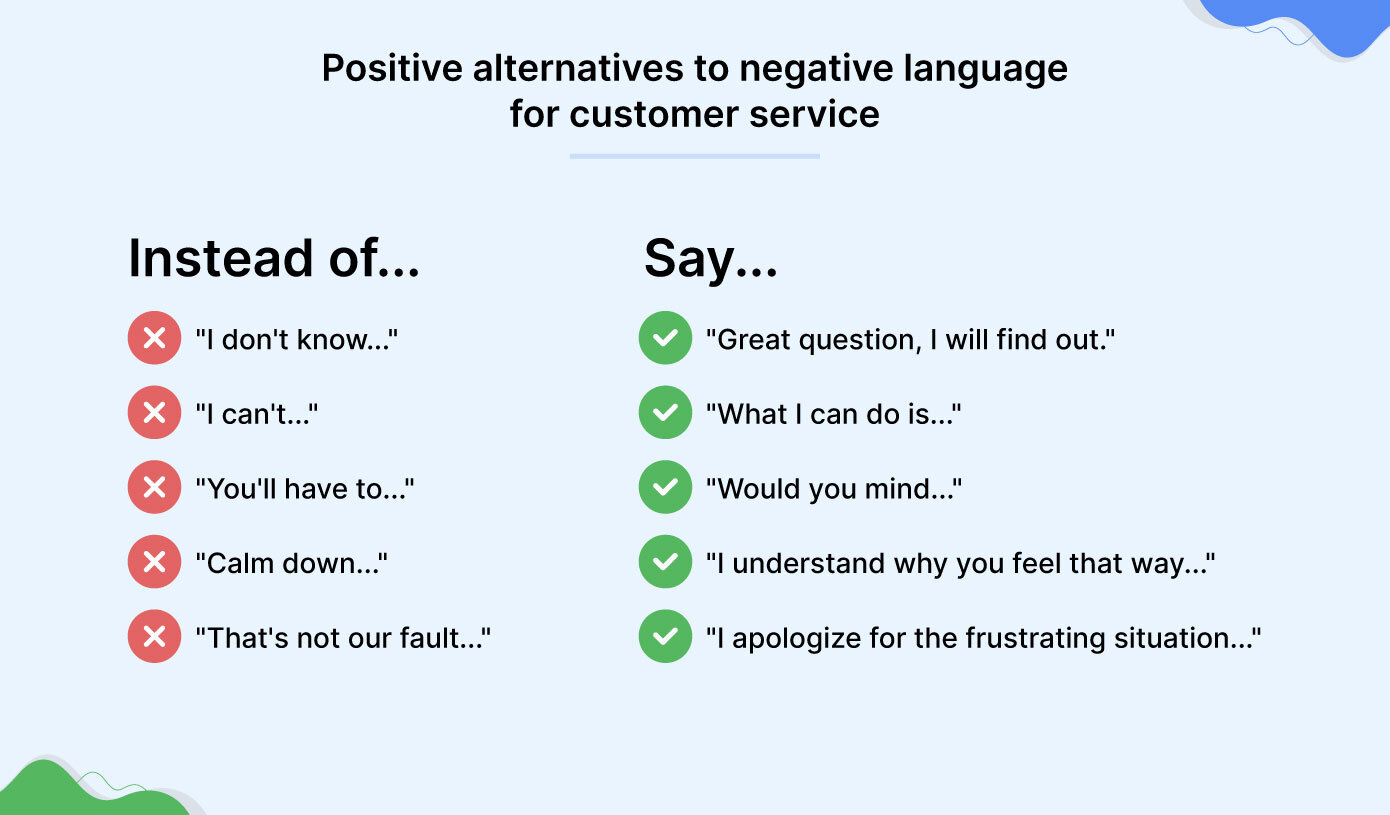

Take responsibility for the mistakes and assure them they will not have to experience them again. Use positive scripting like “Let me look into the matter” instead of “I don’t know” and “Let me speak with my coworker” instead of “I’m new here” to show that you own up to your mistakes.

Doing this will create a very humane and respectable image of yours in the customer’s mind.

8. Practicing Proactive Customer Experience

There are two customer experience types: proactive and the rest. Most businesses fail to offer a proactive customer experience.

A proactive customer experience is a holistic approach to creating such an experience for the prospect or customer that they may never have an opportunity to be displeased, let alone angry.

- Using data and rigorous testing methods to understand customers’ pain points and how they want them solved.

- This can be done by developing products and services that are easy to use, transport, store, and maintain.

- You can proactively share them with customers by adding links to the digital business card, using the best digital card software as your email signature. That way, they can reach out to you with queries, minimizing the chance of dissatisfaction.

- AI-driven, conversational chatbots on websites can help offer answers and support to general queries 24/7.

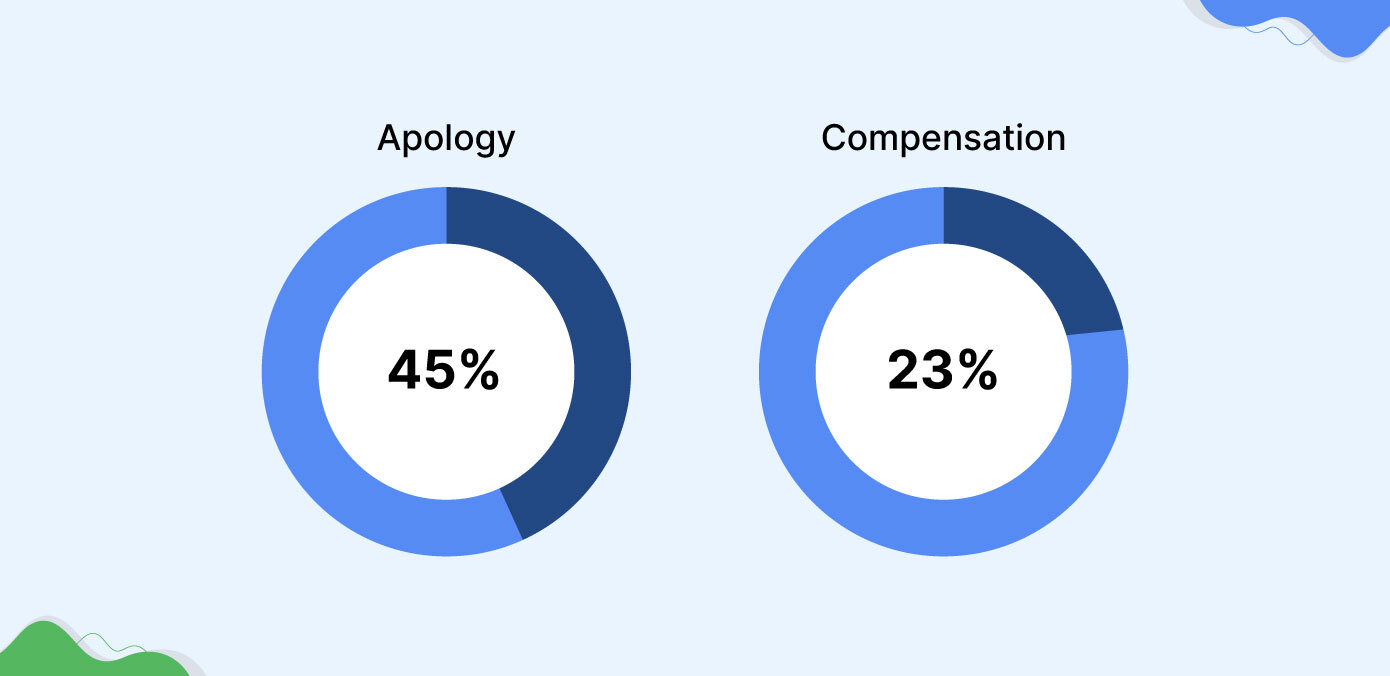

9. Offer Incentives As A Token Of Apology

Sometimes a sorry isn’t enough. And when it comes to angry customers, incentives go a long way to mend the fence between you and your client.

Give away free eBooks, guides, discounts, rebates, or extra services, or credit their account at the end of your support interactions. Such small offerings will reciprocate them to do a favor for you in the long run.

If you have associated with this customer for a long time, you might consider giving an apology gift customized to their interest.

For example, tickets to an event or a restaurant gift certificate, along with a letter or call of apology. This communicates that you value them as a client.

Please note that you go through your company’s policy and theirs if your customer is an organization. Organizations often have rules for accepting and sending gifts.

10. Use A Script

While sounding robotic is never ideal, having an outline to follow during heated interactions can help call center agents remain composed. When facing irate customers, scripting key phrases enables agents to communicate clearly and empathetically, even when feeling flustered.

Start by acknowledging the customer’s frustration and apologizing for the issue. Express understanding through comments like “I can certainly see why you are upset about this situation.” Ask questions to better comprehend the customer’s perspective. Paraphrase their concerns back to demonstrate active listening.

Once the customer feels heard, gently transition to problem-solving mode. Reference your troubleshooting guides to provide solutions. Focus on what you can do to make things right rather than what has already gone wrong. Offer next steps and set reasonable expectations.

Closing the interaction on a positive note is key. Thank the customer for their time and patience. Express confidence the issue will be resolved to their satisfaction. Follow up promptly with the progress.

Having go-to phrases helps agents navigate challenging conversations. While scripts shouldn’t sound overly formal, they enable representatives to remain focused, professional, and solution-oriented. Customers appreciate speaking with agents who truly listen and prioritize their satisfaction.

11. Humor Is A Potent Tool

Humor is quite an antidote to anger because laughter reduces cortisol — the hormone released during stress and increases the overall oxygen intake, making a person feel less angry biologically.

Moreover, humor makes way for more trust and sales. In the book “Yes! 50 Scientifically Proven Ways to Be More Persuasive,” authors Robert B. Cialdini, Noah J. Goldstein, and Steven J. Martin stated that sending a funny, inoffensive cartoon to prospects and customers generated higher levels of trust—and led to 15 percent larger profits.

However, as a sales representative, you can only use humor marginally and with utmost caution.

Humor cannot be directly used with an angry or dissatisfied customer. It can only be used once you have mellowed down the situation in other ways; otherwise, you might appear absurd and even end up angering the patron more.

Follow-up texts or emails to an angry or dissatisfied customer, written communication with an angry customer, or one that’s gone AWOL or MIA are potential spaces to imbue humor for pacifying and retaining customers.

Bonus Tips:

1. Use Self-Deprecating Humor

Sales humor at your own expense is safe. It shows the real human behind the salesperson and helps build connection and trust. But don’t make yourself appear incompetent. If you are in a position of authority, avoid using humor.

2. Use Light Humor

Here’s an example of support staff responding to an unhappy customer with light humor — offering an excellent customer experience.

3. Be Politically-Correct

Refrain from humor on politics, religion, race, age, looks, social status, and other protected clauses. Even with the most loyal customer you’ve known for many years.

12. Have an Angry Caller Policy In Place

An angry caller policy safeguards both customers and staff. In simple terms, it is a policy that puts the steps to deal with angry customers. It helps sales reps know how to respond effectively and draw the line between anger and abuse and disengage the conversation. It should help them know all the types of things to not accept from the callers, like discriminative terms, threats of violence, name-calling, swearing, etc.

So, how to calm down an angry customer? Here are some important points to include in an angry caller policy:

- The Three-Strike Rule – Sales reps must offer two verbal warnings to the customer before hanging up an angry phone call. Of course, this needs to be done diligently and diplomatically. That is to say that the agent has tried to work alongside the customer, and they just aren’t ready to speak in a civilized manner.

- When To Ask For Help: The policy should include when to ask seniors for assistance — having people with more expertise and experience listen to an angry call can be useful. They know when it is appropriate to cut things off; it is also a good help for the agents to learn for the future.

- Follow-Ups: Even though there is no room for verbal abuse from a customer, you never want to lose sight of the customer and the sales they might bring to the company. If a customer or prospect leaves you with a bitter note, you are likely to experience some negative branding. Having follow-up communication can help mend ties and also retain them. Therefore the policy should state how often to try to reconnect with an abusive caller, through which medium, and who should be speaking to them.

- Rules For Repeat Offenders – Unfortunately, angry, abusive callers will repeat their behaviors. Your course of action that was on the first time can’t be the same the fourth time. You may perhaps ask them to never call again and decide how to undo ties with them forever.

- Training Staff: You must train sales and customer support staff on the best practices for dealing with angry customers. The policy should also mandate such training, including training outline, assessment method, and timelines for refresher training.

- Help Advisory For Staff: More often, the noticed angry calls, even the mild ones, can take a toll on call center staff. Calls not picked up, abruptly being disconnected, etc., also affect the mental health of agents in the long run. They tend to develop low self-esteem, anger issues, become anxious, and also develop a cynical worldview. The policy should state ways to get professional help. Partnering with enterprise mental health centers is an absolute must.

Strengthening Customer Relations With Quality Customer Service

Dealing with angry customers is never easy, but following these 12 tips on how to handle angry customers in a call center can help call center agents handle these difficult interactions professionally and empathetically. The keys are remaining calm, actively listening, understanding the customer’s perspective, apologizing sincerely when appropriate, and resolving the issue.

Agents can learn how to smoothly navigate heated conversations with practice and dedication to customer satisfaction. While some customers may remain unreasonable no matter what an agent does, most people will calm down if they feel heard, understood, and cared for. Learning to tap into emotional intelligence, see things from the customer’s point of view, and provide helpful solutions or alternatives goes a long way.

Companies investing in empathy training and support for call center staff see dramatic improvements in customer satisfaction and retention rates. Excellent customer service software tools are available today that can assist agents with tracking issues, routing calls, accessing information, and ensuring follow-through.

By arming agents with knowledge and technology, call centers can deliver exceptional service – even when customers are enraged. Dedication and care can transform any fiery conversation from fueling frustration to fostering goodwill.

FAQ-

What Not To Say To An Angry Customer?

Avoid saying things that could upset the customer, like “Calm down” or “You’re overreacting.” Instead, listen carefully, apologize sincerely, take responsibility, and focus on resolving the issue respectfully and efficiently. Blaming, dismissing concerns, or losing patience will likely escalate the situation.

What Is The Benefit Of Dealing With An Angry Caller?

Though challenging, dealing with an angry caller presents an opportunity to turn a negative experience into a positive one. You can earn back the customer’s trust and satisfaction by listening attentively, empathizing, and working to resolve the issue. This can strengthen loyalty and improve your company’s reputation.

Subscribe to our newsletter & never miss our latest news and promotions.

![How to Handle Angry Customer in Call Center? [12 Proven Ways] How to Handle Angry Customer in Call Center? [12 Proven Ways]](https://callhippo.com/blog/wp-content/uploads/2021/06/Proven-Ways-To-Tackle-An-Angry-Caller-In-A-Call-Center.jpg)