Auto dialers have become essential tools for insurance agents looking to improve their productivity. By automating the dialing process, insurance agents can focus more on having meaningful conversations and less on repetitive tasks. In fact, a recent study shows that using auto dialer software can increase contact rates by up to three times, meaning agents can connect with more potential clients in less time. In this blog, I will walk you through how an insurance dialer works and how it can help insurance agents improve their productivity, make more calls, and grow their business.

When choosing an auto dialer for your insurance business, always look for one that integrates easily with your CRM. This will help you stay organized, track client interactions, and manage leads more effectively. Trust me, having everything in one place makes it easier to stay on top of things and provide better service to your clients.

The Importance of Auto Dialers for Insurance Agents

Auto dialers have become a must-have tool for insurance agents looking to organize their daily tasks and focus more on what matters—building strong relationships with clients. Unlike traditional methods, where dialing and managing contacts manually can take up hours, tools like an auto dialer for insurance agents easily handle these tasks. This means agents can make more calls, connect with more leads, and close more deals in less time. Here’s why a power dialer, such as an insurance dialer, is a game-changer for agents:

- Boosts Productivity: By automating dialing and managing call lists, agents can avoid the repetitive task of manual dialing and focus on meaningful conversations.

- Better Lead Management: Integrated with CRM systems, these tools allow real-time updates, helping agents keep track of client information effortlessly.

- Enhanced Customer Interaction: With more time saved on admin work, agents can dedicate their energy to providing personalized advice and addressing customer needs.

- Cost-Effective Solution: With an agency dialer, you can handle a higher call volume without increasing team size, saving on operational costs.

As you can see, from helping you with acquiring new clients to nurturing existing ones, a power dialer simplifies the process, allowing you to stay ahead in the competitive insurance market. 11 Best Free Auto Dialer Software

Types of Auto-Dialers Available in the Market

For insurance agents, choosing the right type of auto-dialer can make all the difference in how smoothly their communication runs. Let’s explore the main types of auto-dialers available in the market:

1. Preview Dialers

A preview dialer lets you see the contact details of the person you’re calling before the call starts. This gives you time to prepare, making it a great choice when dealing with complex insurance policies or personalized client interactions. It’s perfect for an assurance dialer setup where accuracy and preparation matter.

2. Power Dialers

Power dialers automatically call numbers from your list one at a time but only connect you when the call is answered. This saves time and keeps your day moving, especially if you’re handling a high volume of calls. It’s ideal for an auto dialer for insurance agents who need to work quickly but effectively.

3. Predictive Dialers

Predictive dialers take automation a step further. They use algorithms to dial multiple numbers at once, making them ideal call center dialer solutions for high-volume environments. They connect agents to live calls efficiently, though may not suit situations requiring a personal touch. Predictive Dialer Pricing: Key Features and Cost Breakdown

4. Progressive Dialers

Progressive dialers combine speed and control. They only place a call when an agent is available, ensuring that no answered calls go unattended. This balance makes them a popular choice among auto dialers for insurance agents who want both productivity and customer satisfaction. Choosing the right agency dialer depends on your workflow, the number of calls, and the need for a personal touch. 7 Best Real Estate Dialers

Pros and Cons of Using an Auto Dialer in the Insurance Industry

Auto dialer software has become a vital tool for many insurance agents and agencies, helping them optimize communication with clients and prospects. But like any tool, they come with their own set of benefits and challenges. Let’s understand how an auto dialer for insurance agents can help—and where it might fall short.

Auto Dialer Pros

A. Save Time and Boost Efficiency: Manually dialing numbers is time-consuming and prone to errors. With an insurance dialer, agents can automate the process and focus on meaningful conversations rather than wasting time on dialing. This increased efficiency allows agents to connect with more leads daily. B. Accurate Lead Management: An agency dialer helps organize contact lists and ensures that no potential lead is overlooked. It automates follow-ups, ensuring prospects are contacted at the right time, which is key for converting leads into clients. C. Reduce Errors in Calls: An assurance dialer minimizes the chances of calling incorrect numbers or repeating calls to the same client. This creates a more professional impression and avoids frustration on both ends. D. Track and Record Interactions: Most auto dialers come with built-in tracking and call-recording features. These tools let agents revisit conversations, evaluate their performance, and gain valuable insights for improvement.

Auto Dialer Cons

A. Reliance on the Internet: Auto dialers heavily depend on a stable Internet connection. A poor connection can disrupt calls, potentially harming client relationships. This is something agents and agencies need to prepare for by ensuring reliable infrastructure. B. Compliance Challenges: The insurance industry is tightly regulated, especially when it comes to telecommunication. Some auto dialer software may not fully comply with legal standards, leading to risks like fines or legal disputes. It’s crucial to pick a compliant insurance dialer to avoid such pitfalls.

Top 7 Auto Dialers for Insurance Agents

The following are the top 7 auto dialers for insurance agents. Let’s take a closer look at their features, pricing, and benefits to help you choose the best option for your business.

| Platform | Key Features | Best For | Pricing Starts From | Free Trial Available |

|---|---|---|---|---|

| CallHippo | Power-dialer, CRM integration, call recording, analytics, parallel dialing | Insurance agents wanting simple setup, high volume dialing, CRM sync | $18/user/month | 7 Days |

| PhoneBurner | ARMOR® answer-rate optimization, workflow automation, CRM sync, multi-channel outreach | Solo or small-team agents needing high efficiency and dialing consistency | $140/user/month | 7 Days |

| Kixie PowerCall | Multi-line power dialing, SMS, local presence dialing, DNC compliance, conversation intelligence | Agents who want strong connection rates + local-caller IDs | Custom pricing | 7 Days |

| JustCall | Auto/power dialer, AI live assistance, call scoring, omnichannel (call, SMS, WhatsApp), CRM tools | Teams looking for AI-powered dialing plus multi-channel outreach | $29/user/month | Yes |

| Five9 | Predictive & power dialing, CRM integration, blended inbound/outbound, analytics, compliance tools | Mid-sized agencies, contact centers needing full outbound/inbound capabilities | $175/user/month | Yes |

The providers featured in this article were carefully selected after evaluating their features, reliability, and reputation in the market. We assessed each system for its performance, ease of use, and ability to scale with growing business needs. While these options are among the best solutions, it’s important to note that this list is not exhaustive and there may be other suitable providers available..

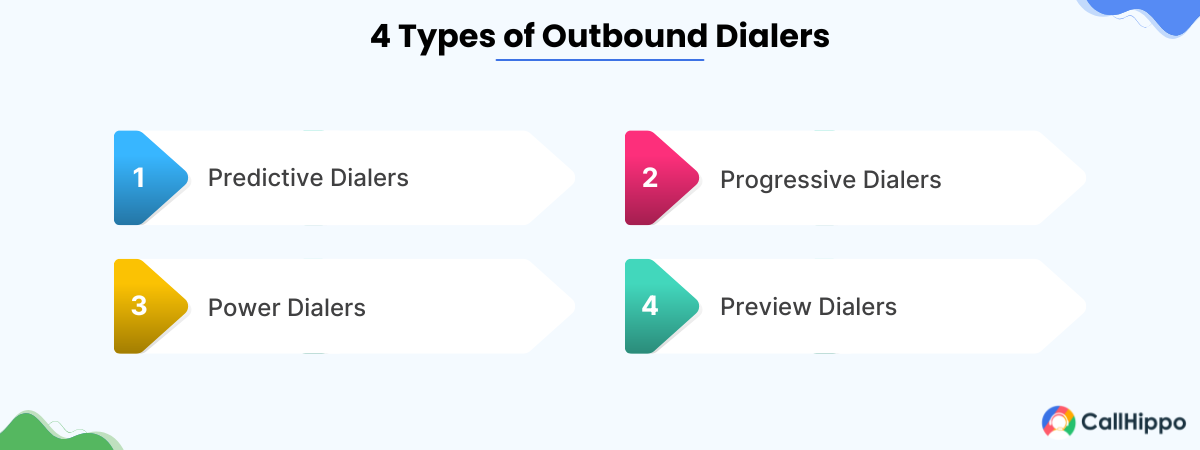

1. CallHippo

CallHippo is one of the best auto dialers for insurance agents, designed to help simplify communication and increase productivity. It allows insurance agents to automate their calling process, saving valuable time and allowing them to focus on what matters most—connecting with clients. With CallHippo’s insurance dialer, agents can handle more calls in less time, improving their overall performance and efficiency. Key Features

CallHippo is one of the best auto dialers for insurance agents, designed to help simplify communication and increase productivity. It allows insurance agents to automate their calling process, saving valuable time and allowing them to focus on what matters most—connecting with clients. With CallHippo’s insurance dialer, agents can handle more calls in less time, improving their overall performance and efficiency. Key Features

- Power Dialer

- Call Forwarding

- Call Recording

- Voicemail

- Text Messaging

- CRM Integration

- Analytics and Reporting

Pros

- CallHippo’s agency dialer automates the dialing process, saving agents time and effort.

- It easily integrates with popular CRM systems, improving workflow and client management.

- CallHippo provides in-depth analytics and reports, helping agents track their performance and make informed decisions.

Cons

- A stable internet connection is essential for the best performance, especially with high call volumes.

- Some advanced features come with additional costs, which might be a limitation for smaller teams.

Pricing: CallHippo offers four pricing tiers as outlined below:

- Starter Plan: $18/month

- Professional Plan: $30/month

- Ultimate Plan: $32/month

- Enterprise Plan: Custom pricing

*Pricing as of 22-01-2025.

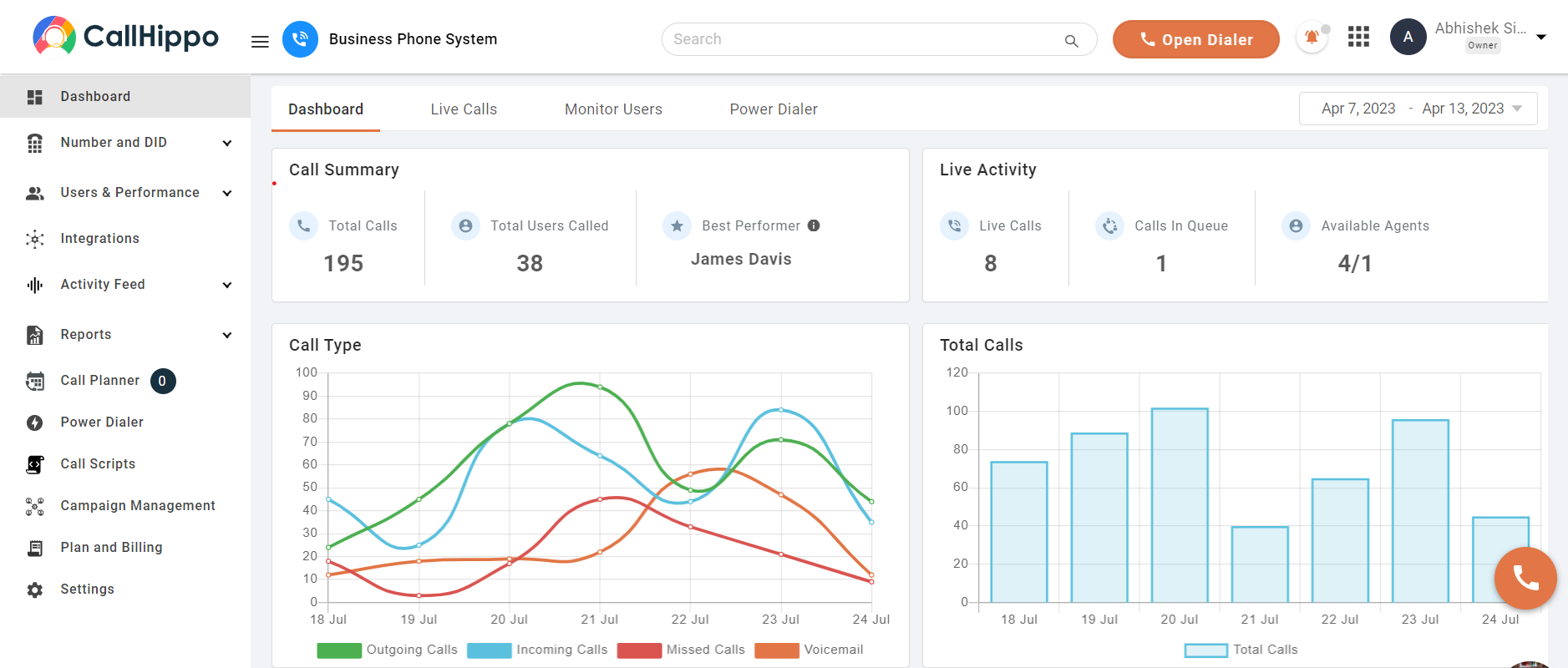

2. PhoneBurner

PhoneBurner is a cloud-based auto dialer for insurance agents designed to enhance productivity and optimize client communications. By automating the dialing process, it allows agents to focus on meaningful conversations, thereby increasing efficiency and client engagement. This insurance dialer is tailored to meet the specific needs of insurance professionals, offering features that simplify daily tasks and improve overall performance. Key Features

PhoneBurner is a cloud-based auto dialer for insurance agents designed to enhance productivity and optimize client communications. By automating the dialing process, it allows agents to focus on meaningful conversations, thereby increasing efficiency and client engagement. This insurance dialer is tailored to meet the specific needs of insurance professionals, offering features that simplify daily tasks and improve overall performance. Key Features

- Power Dialer

- ARMOR® Answer Rate Optimization

- Workflow Automation

- Lead Management

- CRM Integration

- Reporting and Analytics

- Multi-Channel Outreach

Pros

- Automates dialing, enabling agents to connect with more clients.

- Provides tools for personalized communication, improving client relationships.

- Offers detailed analytics to track performance and optimize strategies.

Cons

- Some users will require time to fully utilize all features.

- May not support all international calling needs.

Pricing: PhoneBurner offers three pricing tiers as outlined below:

- Standard Plan: $140 per user/month (billed annually) or $165 billed monthly

- Professional Plan: $165 per user/month (billed annually) or $195 billed monthly

- Premium Plan: $183 per user/month (billed annually) or $215 billed monthly

*Pricing as of 22-01-2025.

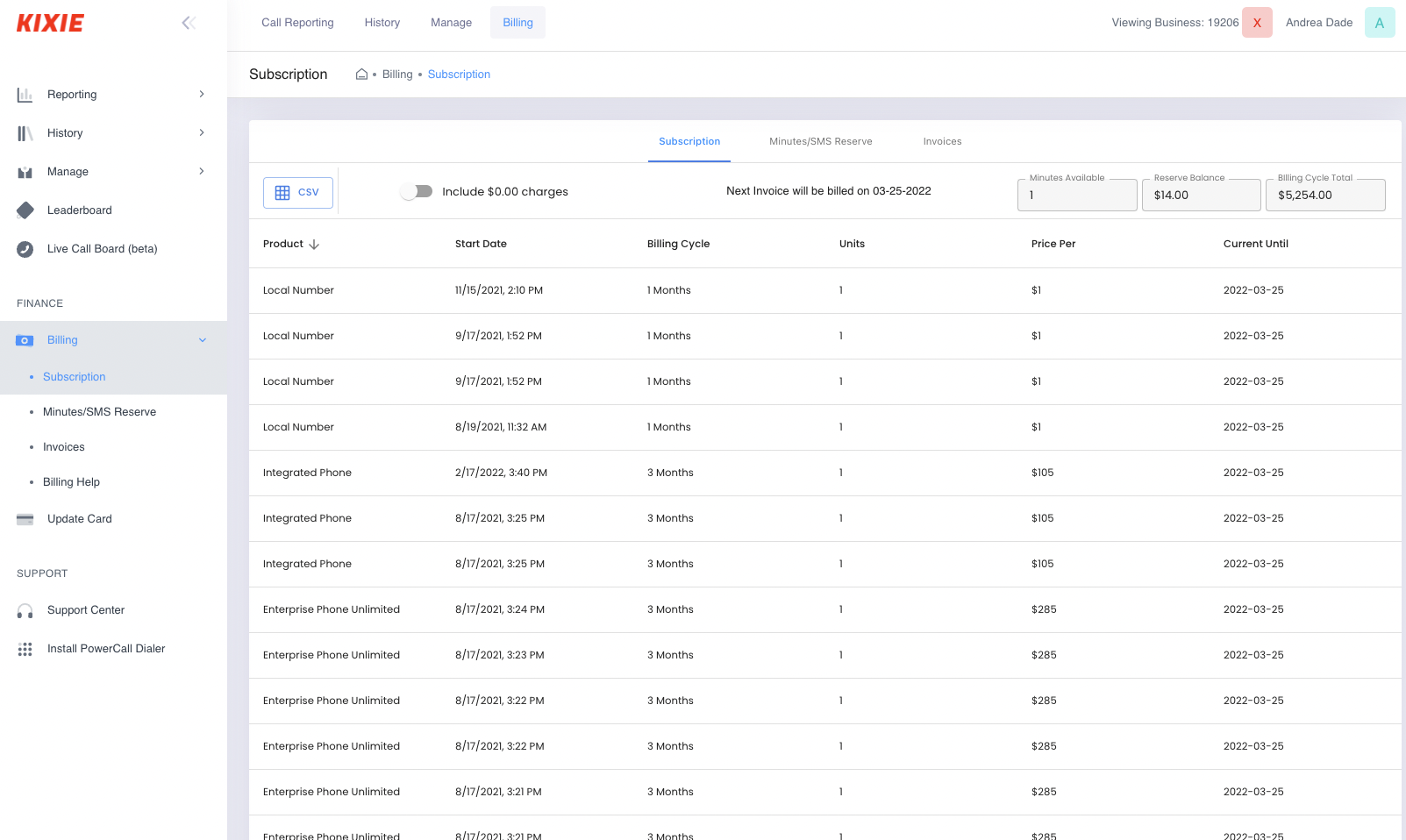

3. Kixie PowerCall

Kixie PowerCall is a cloud-based auto dialer for insurance agents that helps increase productivity by automating the calling process. It integrates seamlessly with CRM systems, making it easier for agents to manage leads and client interactions. This insurance dialer is designed to optimize time management for insurance professionals, letting them focus more on conversations than dialing numbers. Key Features

Kixie PowerCall is a cloud-based auto dialer for insurance agents that helps increase productivity by automating the calling process. It integrates seamlessly with CRM systems, making it easier for agents to manage leads and client interactions. This insurance dialer is designed to optimize time management for insurance professionals, letting them focus more on conversations than dialing numbers. Key Features

- Multi-line Power Dialer

- Team SMS

- Connection-Boost

- Conversation Intelligence

- Intelligent Call Routing

- DNC List Compliance

- Caller ID Reputation

Pros

- Increases agent productivity by automating dialing processes.

- Enhances lead management with seamless CRM integration.

- Improves call connection rates through local presence dialing.

Cons

- Requires a stable internet connection for optimal performance.

- May involve a learning curve for new users.

Pricing: Kixie provides tailored pricing plans based on your business needs. For more details, visit their pricing page.

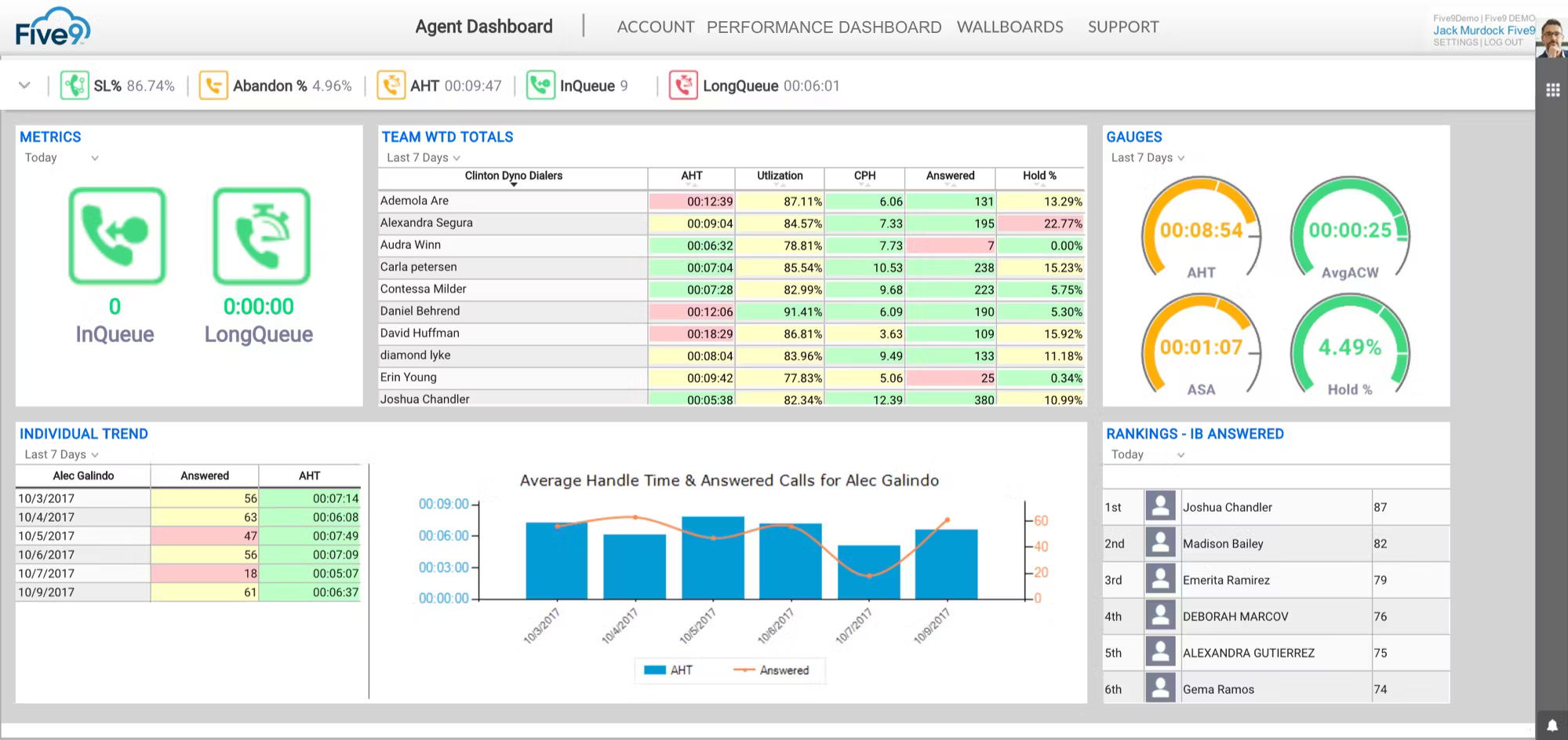

4. RingCentral Engage Voice

RingCentral Engage Voice is a cloud-based auto dialer for insurance agents designed to help businesses improve customer interactions. It automates calls to save agents valuable time and boosts productivity. This insurance dialer makes it easy to connect with clients quickly, offering seamless integration with other tools and providing actionable insights to optimize performance. Key Features

RingCentral Engage Voice is a cloud-based auto dialer for insurance agents designed to help businesses improve customer interactions. It automates calls to save agents valuable time and boosts productivity. This insurance dialer makes it easy to connect with clients quickly, offering seamless integration with other tools and providing actionable insights to optimize performance. Key Features

- Predictive Dialing

- Interactive Voice Response (IVR)

- Call Recording

- Real-Time Analytics

- CRM Integration

- Omnichannel Support

- AI-Powered Assistance

Pros

- Real-time analytics helps improve decision-making and performance.

- Provides call recording for better tracking and training purposes.

- AI-powered features ensure efficient and personalized responses.

Cons

- Can be costly for small businesses with limited budgets.

- Needs consistent updates for effective system functionality.

Pricing: RingCentral Engage Voice offers flexible pricing plans to suit various business needs. For detailed pricing information, please visit their official website.

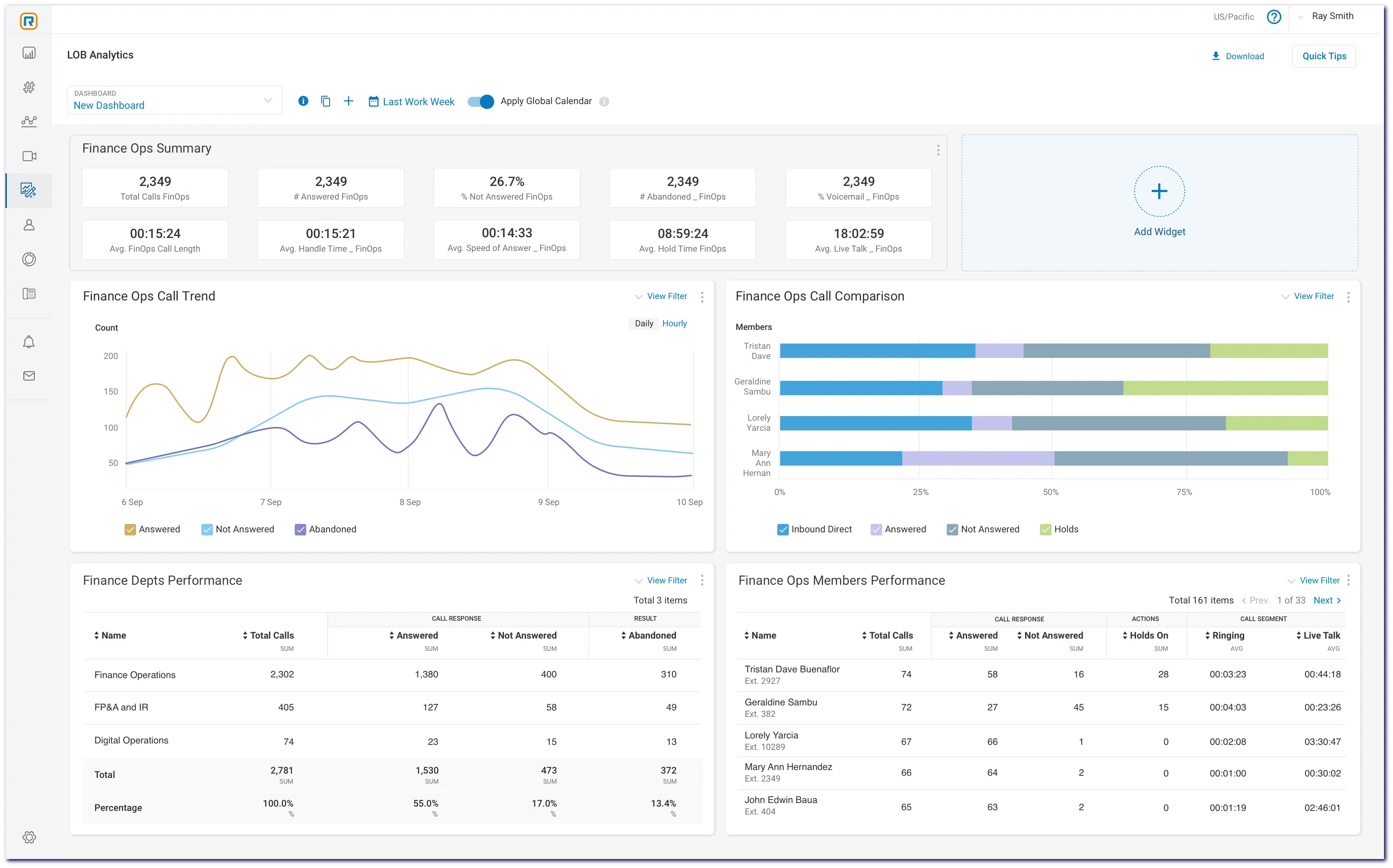

5. Five9

Five9 is a powerful auto dialer for insurance agents, designed to enhance the efficiency of outbound communication. With advanced features like predictive dialing and seamless CRM integration, it helps insurance agents automate calls, reach more leads, and reduce manual tasks. This insurance dialer supports various dialing modes, making it an excellent tool for improving productivity and client engagement. Key Features

Five9 is a powerful auto dialer for insurance agents, designed to enhance the efficiency of outbound communication. With advanced features like predictive dialing and seamless CRM integration, it helps insurance agents automate calls, reach more leads, and reduce manual tasks. This insurance dialer supports various dialing modes, making it an excellent tool for improving productivity and client engagement. Key Features

- Predictive Dialer

- Progressive Dialer

- Power Dialer

- Preview Dialer

- TCPA Manual Touch Mode

- Certified Caller (STIR/SHAKEN)

- CRM Integrations

Pros

- Reduces agent idle time, boosting productivity.

- Enhances connection rates with advanced technologies.

- Minimizes dialing errors, ensuring accurate client outreach.

Cons

- Requires a stable internet connection for optimal performance.

- Compliance with regulations may necessitate additional configurations.

Pricing: Five9 offers customized pricing based on specific business needs. For detailed information, contact Five9 directly.

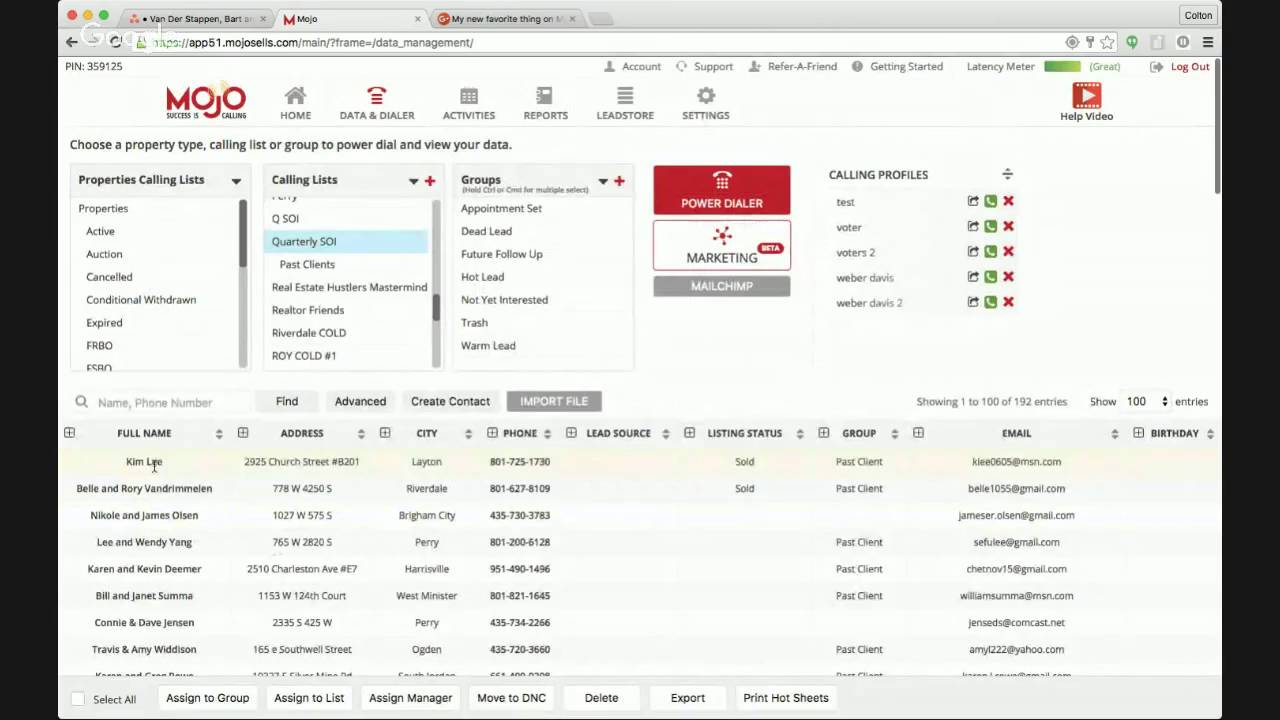

6. Mojo Dialer

Mojo Dialer is a well-known auto dialer for insurance agents that helps simplify communication with leads and clients. This insurance dialer simplifies the dialing process, making it faster and more effective for agents. With its powerful features like multi-line dialing and CRM integration, Mojo Dialer ensures that agents can focus more on building relationships and closing deals. Key Features

Mojo Dialer is a well-known auto dialer for insurance agents that helps simplify communication with leads and clients. This insurance dialer simplifies the dialing process, making it faster and more effective for agents. With its powerful features like multi-line dialing and CRM integration, Mojo Dialer ensures that agents can focus more on building relationships and closing deals. Key Features

- Single Line Power Dialing

- Multi-Line Power Dialing

- Caller ID Whitelisting

- Flexible Calling Modes

- Click-to-Call

- Flexible User Roles and Permissions

- Seamless CRM Integration

Pros

- Offers multi-channel support, including voice, email, and chat.

- Predictive dialing reduces idle time for agents.

- Customizable IVR options help manage customer queries.

Cons

- Needs consistent updates for effective system functionality.

- Limited functionality on lower-tier plans.

Pricing: Mojo Dialer offers three pricing tiers as outlined below:

- Single Line Dialer: $99 per license

- Triple Line Dialer: $149 per license

- Mojo CRM: $10 per user

*Pricing as of 22-01-2025.

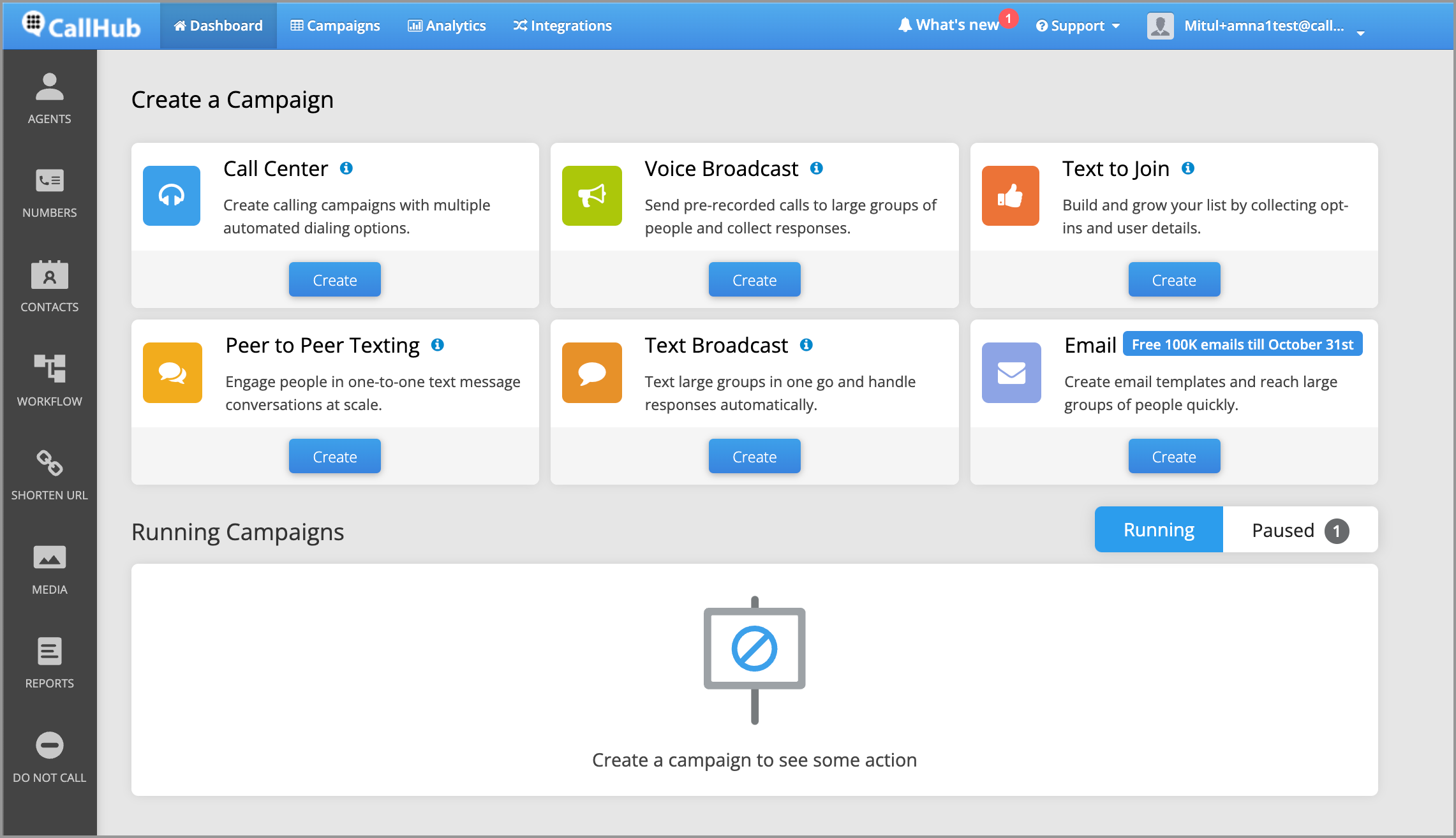

7. CallHub

CallHub offers an auto dialer for insurance agents that simplifies communication by automating the dialing process. This insurance dialer helps insurance agents save time by automatically calling clients and leads, allowing them to focus more on conversations. With features like call recording, CRM integration, and predictive dialing, this agency dialer enhances efficiency and customer service. Key Features

CallHub offers an auto dialer for insurance agents that simplifies communication by automating the dialing process. This insurance dialer helps insurance agents save time by automatically calling clients and leads, allowing them to focus more on conversations. With features like call recording, CRM integration, and predictive dialing, this agency dialer enhances efficiency and customer service. Key Features

- Predictive Dialing

- Call Recording

- CRM Integrations

- Dynamic Caller ID

- Automated Voicemail Drops

- Call Analytics

- Inbound Calling

Pros

- Enables faster client interactions with fewer dropped calls.

- The cloud-based platform ensures easy access from anywhere.

- Customizable IVR options help manage customer queries.

Cons

- Higher-tier features may not be necessary for all users.

- Can become complex when dealing with large teams.

Pricing: CallHub operates on a pay-as-you-go model, charging 4¢ per dial and 3.4¢ per text, with options for bulk discounts. *Pricing as of 22-01-2025.

Top Features to Look for in an Auto Dialer for Insurance Agents

When choosing the right auto dialer for insurance agents, it’s important to focus on features that can improve efficiency and help agents handle more calls in less time. Here are some key features to look for: 1. Automated Dialing: A good insurance dialer should automatically dial your numbers. This allows agents to focus on talking to clients instead of wasting time dialing manually. By automating the process, agents can reach more prospects and clients in a shorter period. 2. Integration with CRM Systems: An auto dialer for insurance agents should easily integrate with your CRM. This helps you keep track of all client information, manage leads, and stay organized. When everything is synced, you can have more meaningful conversations with clients and provide better customer service. 3. Call Recording and Reporting: Many agency dialers come with call recording features that allow you to listen to past conversations. This helps with training new agents, monitoring performance, and ensuring that customer interactions follow best practices. Detailed reports also help you track success rates and improve your approach. 4. Compliance Features: Compliance is critical in the insurance industry. A good assurance dialer will help you stay compliant by automatically checking Do Not Call (DNC) lists and keeping track of important regulations like call recording laws. 5. Multi-Channel Capabilities: A modern auto dialer should support different channels like calls, emails, and text messages. This flexibility allows agents to communicate with clients in the way that suits them best, increasing the chances of successful outreach. With these features, an auto dialer can significantly improve the productivity of insurance agents, making it easier to manage leads, stay compliant, and provide better customer experiences. Auto Dialer vs. Predictive Dialer: What’s the Difference?

Why Is CallHippo the Best Option?

CallHippo is a standout option for insurance agents looking for a reliable and efficient auto dialer. It provides everything needed to enhance your workflow and is designed to support agencies and individual agents in handling more calls. Here’s why it’s the best choice:

- Easy Integration: As an insurance dialer, CallHippo allows you to easily manage customer information and calls from one platform. This integration helps you track data in real time and ensures that important leads are never missed.

- Powerful Features: From call recording and call forwarding to automatic scheduling, CallHippo provides everything an agency dialer needs. These features not only improve efficiency but also help boost customer satisfaction by enabling better communication.

- User-Friendly Interface: CallHippo is incredibly easy to use. The interface is intuitive, meaning even less tech-savvy agents can get up and running quickly. With minimal setup time, agents can focus on what matters most—serving clients.

All these aspects make CallHippo the best auto dialer for insurance agents.

Conclusion:

An auto dialer for insurance agents can significantly boost productivity, optimize client interactions, and improve overall efficiency. By automating the dialing process, these tools help agents focus on what matters most—building strong relationships with clients. Among the many options available, CallHippo stands out for its ease of use, powerful features, and integration with CRM systems. If you are looking to optimize your calling process, CallHippo is an excellent choice for both individual agents and insurance agencies.

FAQs

1. Are auto dialers illegal?

Auto dialers are not illegal, but they must comply with regulations like the Telephone Consumer Protection Act (TCPA) to avoid legal issues, especially regarding unsolicited calls.

2. How much do auto dialers cost?

Auto dialer costs vary, typically ranging from $18 to $215 per month depending on features, such as call volume, CRM integration, and advanced analytics.

3. What is an auto dialer agent?

An auto dialer agent is software that automatically dials phone numbers for agents, connecting them to live calls. It saves time and enhances productivity by automating dialing.

4. Is there a free auto dialer available?

Some auto dialers offer free trials or basic versions with limited features. However, full-featured auto dialers usually require a paid subscription to unlock all capabilities.

5. How many calls can an auto dialer make?

The number of calls an auto dialer can make depends on the plan and system setup. Some dialers can handle hundreds or even thousands of calls daily.

6. What are the requirements for auto dialers under TCPA?

Under TCPA, auto dialers must not call numbers on the Do Not Call (DNC) list, and they must have prior consent from recipients before making automated calls, among other compliance rules.

Subscribe to our newsletter & never miss our latest news and promotions.